|

Getting your Trinity Audio player ready...

|

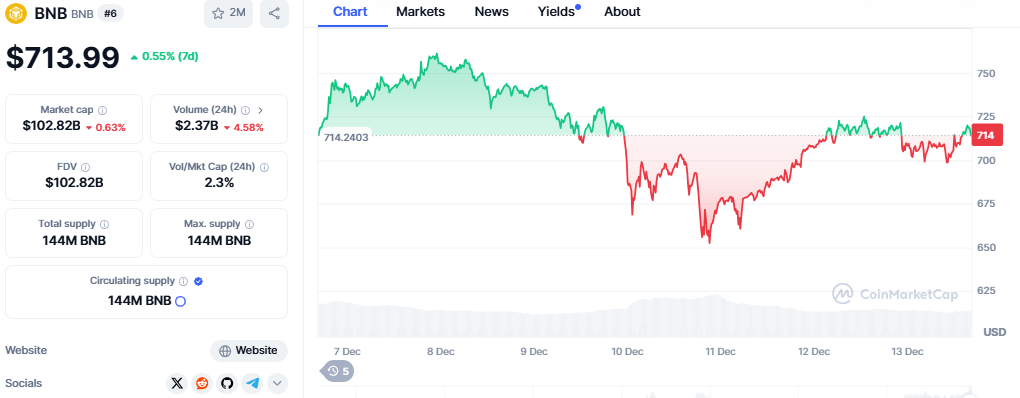

The Binance Coin (BNB) price has seen a slight decline of 1.24% over the past 24 hours, maintaining a market capitalization of $102 billion. Despite this, BNB remains above the $700 mark and retains its position as the 6th largest cryptocurrency in the market. However, with Bitcoin’s price fluctuating near the $100,000 level, the volatility is having a noticeable impact on BNB’s bullish momentum. Investors and traders alike are left wondering: Will this increased volatility lead to a prolonged correction, or is a breakout rally on the horizon?

BNB Price Analysis: Post-All-Time High Pullback

After reaching an all-time high of $794.30, BNB experienced a minor pullback, losing trend momentum. The price dipped to a 7-day low of $649.90, marking a notable 18.18% decline. This pullback occurred despite the broader cryptocurrency market’s recovery. However, BNB’s price has shown resilience, with the cryptocurrency reclaiming the $700 level. Currently, BNB is trading at $709.50, experiencing a modest intraday recovery of 0.48%.

This recovery has negated the possibility of an evening star pattern, as evidenced by the previous day’s candle, which saw a higher price rejection from the $724 level.

Technical Indicators: Bearish Crossover and Bullish Momentum

Looking at technical indicators, BNB’s chart shows a bearish crossover between the MACD and Signal lines, suggesting a short-term weakening of bullish momentum. The daily Relative Strength Index (RSI) is hovering just above the halfway mark, indicating that the bullish dominance is still intact, though it may lack the strength to push prices higher without a broader market catalyst.

BNB Price Targets: A Breakout or Further Correction?

With the recent price reversal from the psychological $650 support level, there is growing optimism for a breakout rally. If the bulls manage to break through the $724 resistance level, a new all-time high could be within reach. A successful breakout could see BNB testing the 1.272 Fibonacci extension at $812.

However, if market volatility intensifies and the bearish trend continues, key support lies at the $600 psychological level, just below the 78.60% Fibonacci retracement. The outcome largely depends on broader market conditions and Bitcoin’s price behavior in the coming weeks.

Also Read: AVA Token Jumps 330% to $3.31S After CZ’s Binance Investment Reveal

As BNB navigates this period of volatility, traders will be watching closely to see whether the cryptocurrency can break past resistance levels or face a prolonged correction.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.