|

Getting your Trinity Audio player ready...

|

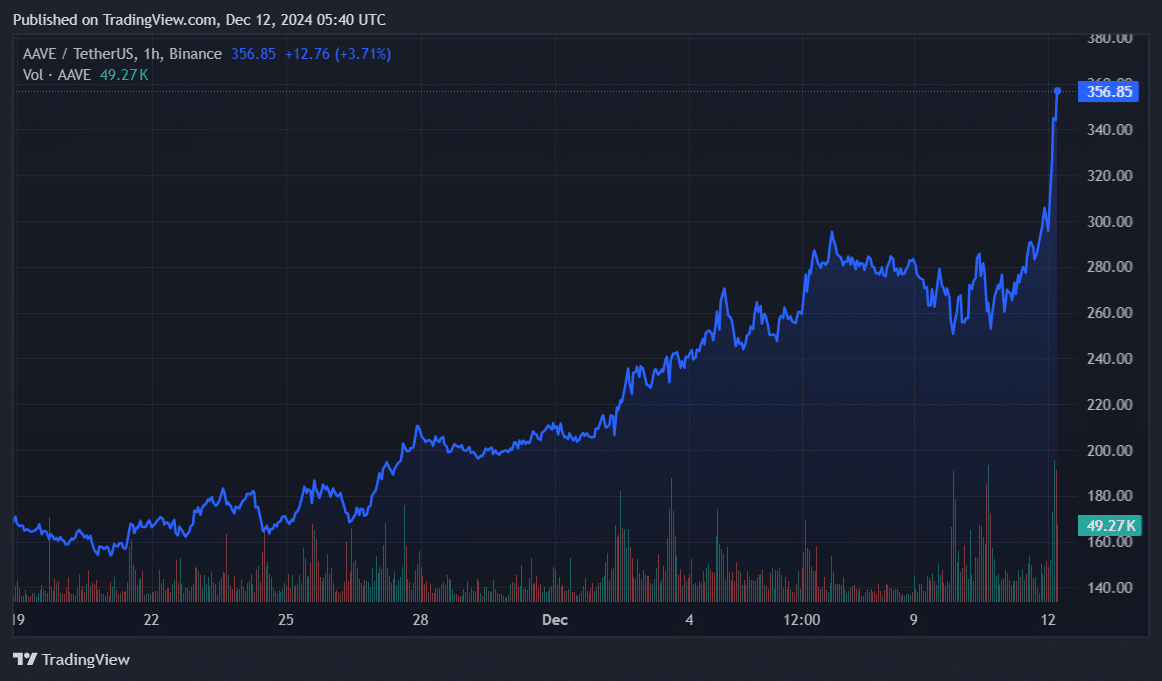

Aave (AAVE) has experienced a remarkable surge, rising by 34% in just 24 hours to reach $355 at the time of writing. This spike in value has propelled Aave’s market capitalization to an impressive $5.3 billion, making it the 31st-largest cryptocurrency by market cap. The surge marks the first time since late August 2021 that Aave has surpassed the $350 mark. What are the driving forces behind this unexpected rally? Let’s take a closer look at the key factors propelling Aave’s meteoric rise.

1. Broader Crypto Market Momentum

The rally in Aave’s price comes amid a broader upswing in the cryptocurrency market. Following the release of the U.S. Consumer Price Index (CPI) report on Wednesday, which showed inflation at a steady 2.7% year-over-year for November, Bitcoin (BTC) saw significant gains. The positive CPI data spurred bullish sentiment in the market, with Bitcoin crossing the $100,000 threshold once again. As Bitcoin surged, it triggered a ripple effect across the entire crypto market, contributing to a 4% increase in the global market cap, which now stands at $3.82 trillion, according to data from CoinGecko. This wider market uplift helped Aave gain momentum as well.

2. New Developments Boosting Aave’s DeFi Ecosystem

Aave’s decentralized finance (DeFi) ecosystem is also seeing positive developments that have further fueled its rally. Aave’s total value locked (TVL) in DeFi currently hovers at an impressive $22 billion. A notable recent partnership is with Balancer, a decentralized exchange (DEX) and automated portfolio management protocol. Balancer is upgrading its system to v3, with Aave playing a key role in optimizing its liquidity pools. This partnership is expected to enhance yields for users, which could bring increased activity to Aave’s platform.

Additionally, Aave is expanding its reach by launching on Linea, a zk-rollup network supported by ConsenSys. This move, which received the green light from Aave’s community, is expected to significantly increase transaction throughput while reducing fees. Such expansions not only enhance Aave’s functionality but also position it as a key player in the future of scalable DeFi solutions.

3. Whale Accumulation and Market Sentiment

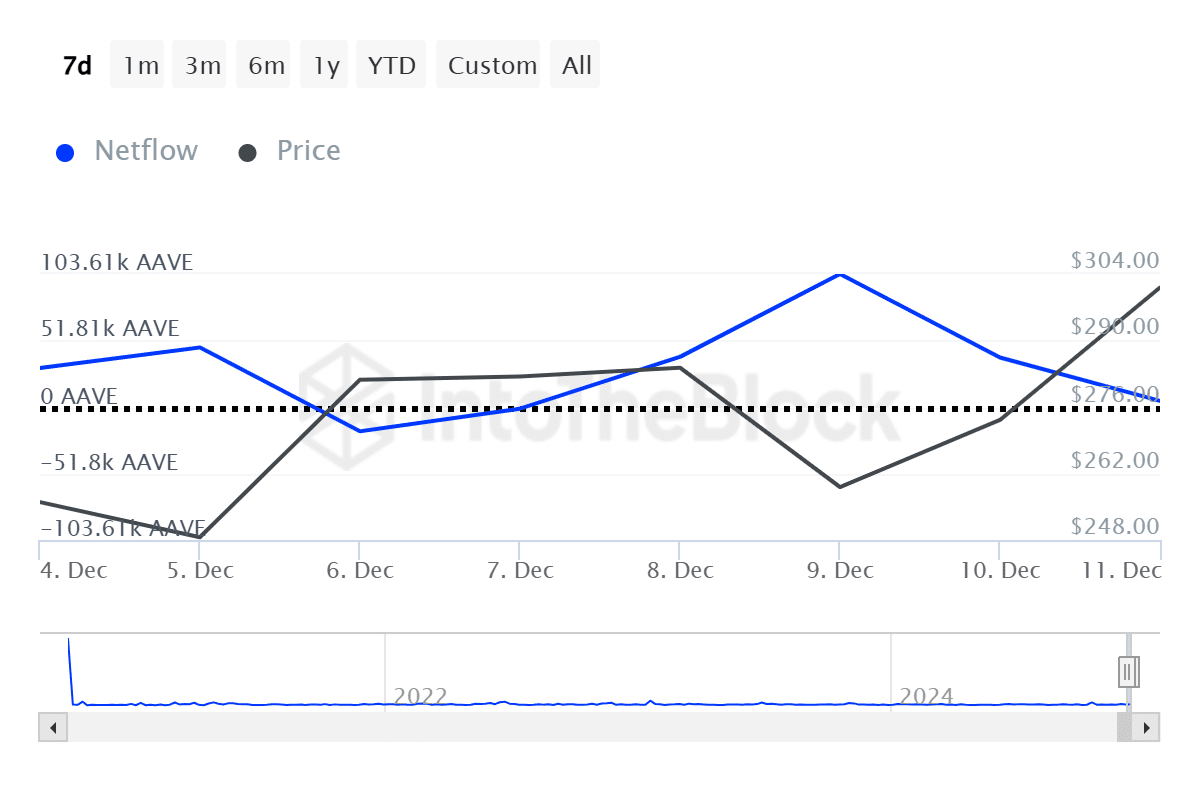

Another factor behind Aave’s price surge is the accumulation of AAVE tokens by large investors, or “whales.” On December 9, whale activity saw a significant spike, with large holders netting 103,610 AAVE tokens as the price dipped below $260. This accumulation often signals confidence in the asset and creates a sense of scarcity. As a result, retail investors may rush to buy, fearing they’ll miss out on further price gains. This type of behavior can further drive up the price, especially when whale accumulation happens during market dips.

4. Political Influence from Trump’s DeFi Project

In a surprising twist, Aave’s rally has been partly fueled by the political scene. President-elect Donald Trump’s DeFi project, World Liberty Financial, recently purchased $1 million worth of AAVE tokens at an average price of $297.8. This high-profile purchase has captured the attention of the crypto community, adding a layer of legitimacy and attention to Aave’s bullish trend.

Aave’s 34% price surge is a result of multiple factors converging at the same time. The broader crypto market rally, Aave’s strategic partnerships, whale accumulation, and even political developments have all played a part in this sudden rise. With Aave’s market cap now at $5.3 billion, the lending protocol’s future looks promising as it continues to innovate and capture the interest of both institutional and retail investors alike.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!