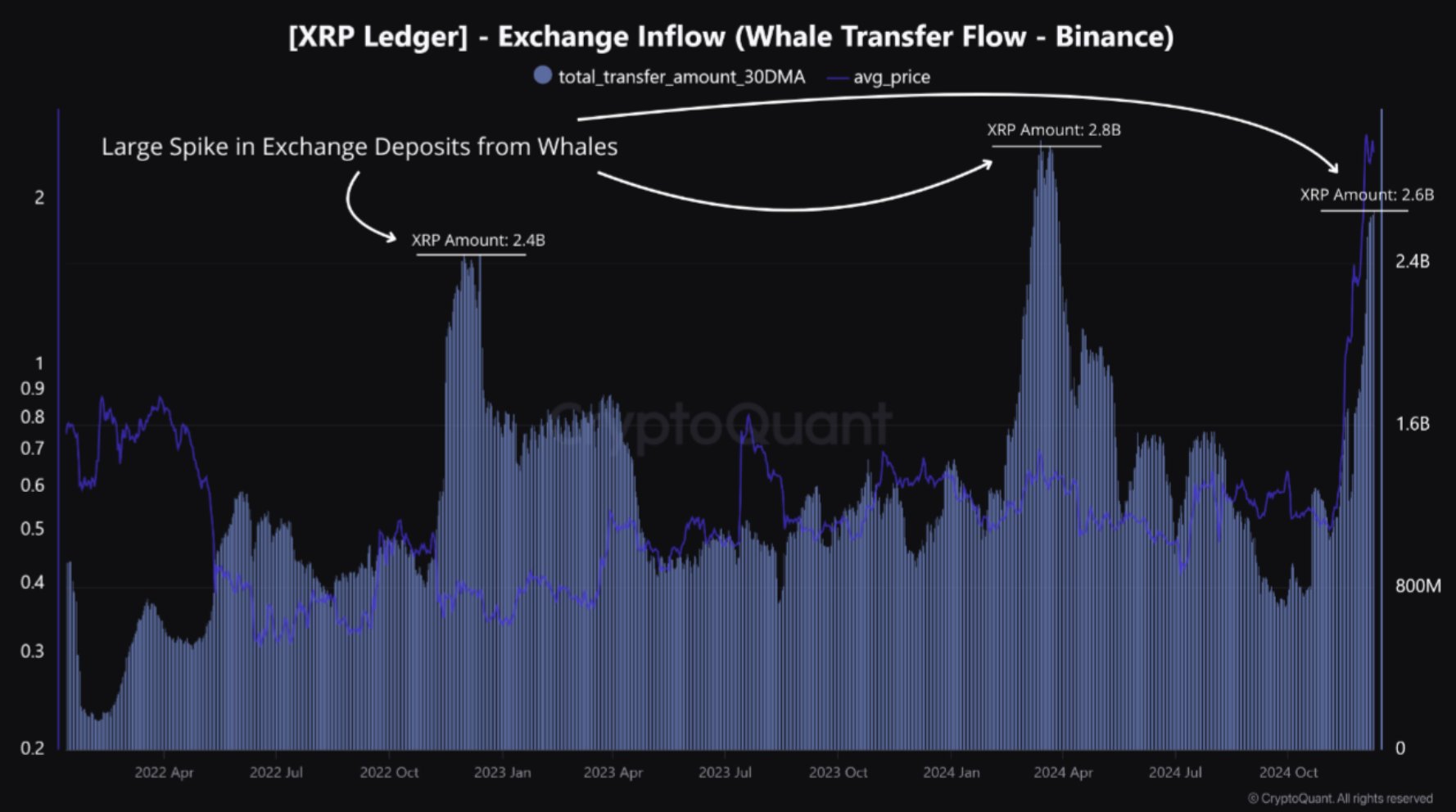

XRP’s price has seen a meteoric rise in the past month, with the digital asset surging over 300%. This increase is not just driven by retail investors but is also strongly correlated with significant whale activity, especially on cryptocurrency exchanges like Binance. According to data from CryptoQuant, the past 30 days have seen whales move a staggering 2.66 billion XRP to Binance, a notable development in the XRP market.

This surge in whale activity is the largest seen since April 2024, when similar movements were observed, and the latest flow is drawing parallels to those historical events. In fact, this is the second-largest whale movement to exchanges since XRP’s whales transferred 2.8 billion XRP back in April. As these massive transfers unfold, it’s crucial to analyze what this means for the price of XRP.

Growing Interest in XRP

CryptoQuant analyst JJ Maartunn suggests that the substantial inflow of XRP into Binance points to an increasing interest from whales. These large holders are likely preparing for either a strategic shift or potential sell-offs. Maartunn speculates that this move could be indicative of a larger trend, with whales possibly seeking to liquidate some of their holdings following the recent surge to a multi-year high of $2.9092.

Despite these concerns, Binance remains one of the largest holders of XRP, with one wallet alone holding 1.8 billion XRP, valued at approximately $4.26 billion. This significant holding positions Binance as a key player in the XRP ecosystem, influencing both its liquidity and price volatility.

Exchange Inflows and Price Corrections

Historically, large exchange inflows have been followed by notable price corrections. For instance, in April and November 2022, similar spikes in XRP exchange inflows were seen just before substantial price drops. In November 2022, XRP saw a 12% correction, falling from $0.4640 to $0.4078. In April of the same year, the cryptocurrency faced a more significant correction, with a 20.4% decline from $0.6292 to $0.5110.

This pattern has raised concerns that the current inflow could signal an impending price drop, as whales could potentially dump their assets once they have moved their holdings onto exchanges like Binance. However, the current bullish sentiment surrounding XRP may act as a buffer against a similar correction.

Bullish Momentum Amidst Uncertainty

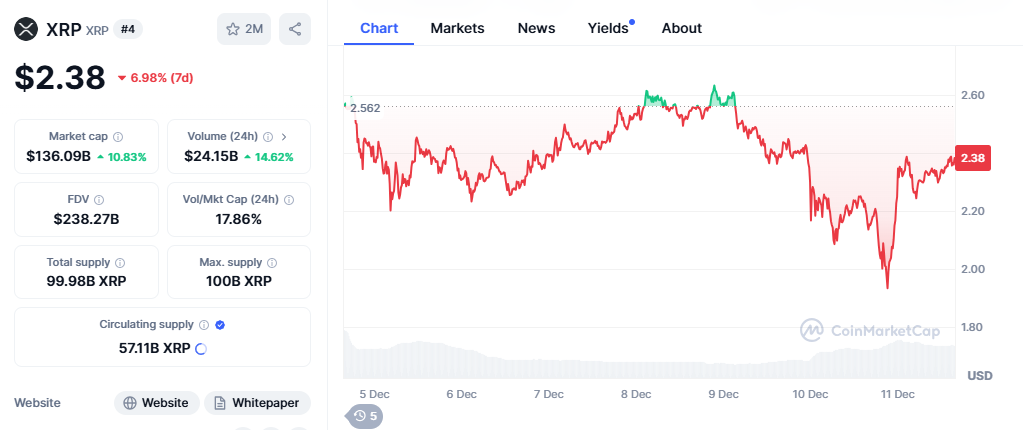

Despite the potential for a price correction, the XRP ecosystem is experiencing bullish momentum. The recent approval of the Ripple-USD (RLUSD) listing by the New York Department of Financial Services (NYDFS) has fueled optimism. XRP saw a 20% bounce, rising from below $2 to around $2.40 shortly after this announcement.

As of now, XRP is trading at $2.3366, marking a 5% increase in the past 24 hours. While the whale movements are noteworthy, the broader ecosystem and regulatory developments may help sustain XRP’s upward momentum, mitigating the risks of a significant price pullback.

Also Read: Ripple Secures Approval for RLUSD Stablecoin: What This Means for XRP’s Future and Market Potential

In conclusion, while the inflow of XRP to exchanges like Binance signals growing whale interest, the market is far from predictable. The potential for both price corrections and further bullish rallies remains high, and investors will need to keep a close eye on the evolving dynamics of whale activity and market sentiment.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.