Hedera Hashgraph (HBAR) is attracting increasing attention in the cryptocurrency market, with ambitious predictions surrounding its future. A market analyst known as @BlockAxis on the social platform X recently shared a bold forecast for HBAR, suggesting that it could reach a price of $100. This prediction is based on a detailed analysis of the global market, HBAR’s utility, and the potential impact of its technological advancements.

A $100 Price Target: Is It Possible?

BlockAxis suggests that for HBAR to hit $100, the network would need a market capitalization of approximately $5 trillion. This target, though ambitious, is grounded in the potential size of the global markets that Hedera is looking to tap into. The analyst points out that the global stock market alone is valued at around $110 trillion, with the derivatives market far exceeding that. Hedera, with its decentralized network and focus on tokenized economies, is strategically positioned to capture a portion of these colossal markets.

One of the key factors that support BlockAxis’s $100 prediction is Hedera’s focus on real-world applications like tokenized assets, supply chain management, and decentralized finance (DeFi). By addressing real-world problems, Hedera creates a solid foundation for future demand for its native asset, HBAR.

For instance, if Hedera captures just 0.5% of the $300 trillion global tokenized real estate market, its network could reach a valuation of $1.5 trillion. With its low transaction fees and energy-efficient protocols, Hedera could also see increased adoption in global payments and lending, further driving HBAR’s demand.

Institutional Backing Adds Credibility

Unlike meme coins that rely on speculative interest, Hedera stands out with its blue-chip credibility. The Hedera Governing Council includes major corporations such as IBM, Google, Boeing, Dell, and Deutsche Telekom. BlockAxis emphasizes that this institutional backing provides Hedera with the credibility needed to foster widespread adoption.

These industry giants, with their combined economic value in the trillions, could play a crucial role in Hedera’s future growth. If Hedera succeeds in tokenizing aspects of these ecosystems, it would significantly increase the demand for HBAR, potentially leading to mass adoption.

The Path to $100: Expansion and Scalability

To reach the $100 price target, Hedera must focus on expanding its ecosystem. This includes attracting developers and businesses to build on the network. Additionally, Hedera’s scalability will be crucial. The network is capable of handling billions of daily transactions, with an impressive 10,000 transactions per second (TPS). At a modest fee of $0.001 per transaction, the resulting demand for HBAR would be immense.

A Bright Future for HBAR

While a $100 target might seem out of reach for some, the strong fundamentals of Hedera, coupled with its innovative technology and powerful institutional backing, make it a compelling investment. With Web3 and tokenized economies projected to grow exponentially by 2030, HBAR’s role in this space positions it for significant growth.

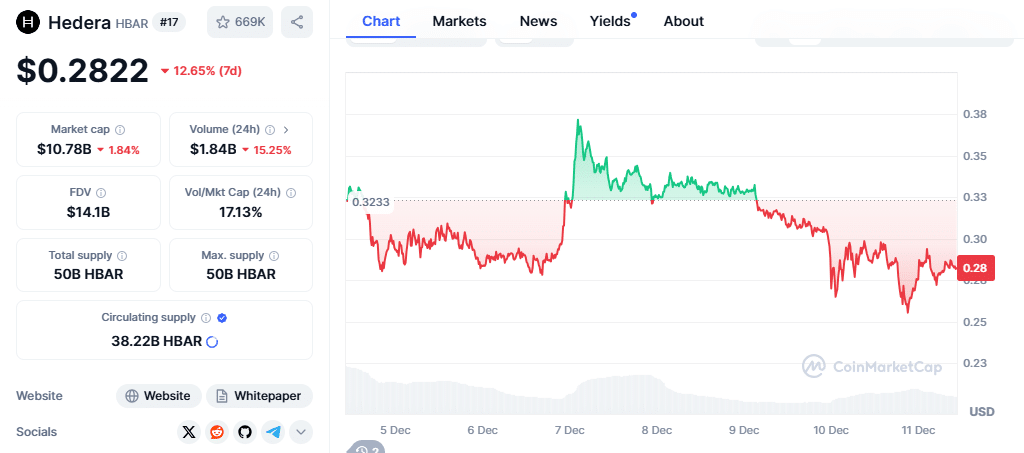

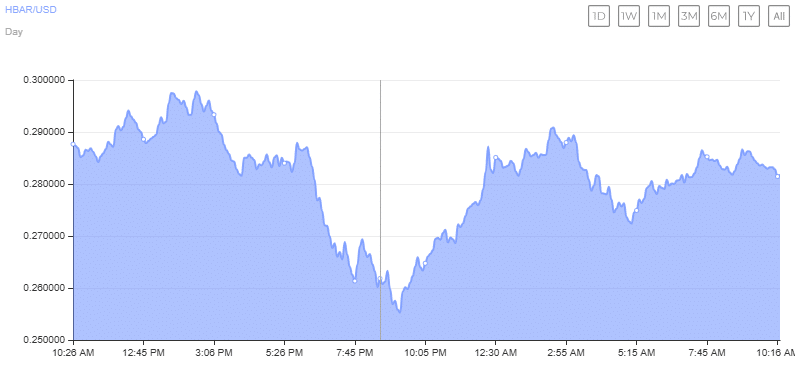

BlockAxis believes that if Hedera captures 5-10% of global tokenized assets, hitting $100 is a realistic goal. As of the latest data, HBAR’s price sits at $0.2919, down 4.09% in the last 24 hours but up an impressive 416% over the past 30 days. The journey to $100 might be long, but Hedera’s trajectory and market positioning are strong indicators of future success.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: HBAR Price Surge: Is Hedera’s Rally Losing Steam Amid Sell Pressure Build-Up?