|

Getting your Trinity Audio player ready...

|

Polygon (POL), the Ethereum Layer 2 scaling solution, has been garnering attention in the crypto market as it shows signs of potential price growth. Following a period of recovery, the altcoin has demonstrated bullish patterns that suggest a possible move towards its all-time high (ATH) of $2.9. But is Polygon truly set for a breakout, or is this just another temporary rally?

Polygon’s Recent Momentum

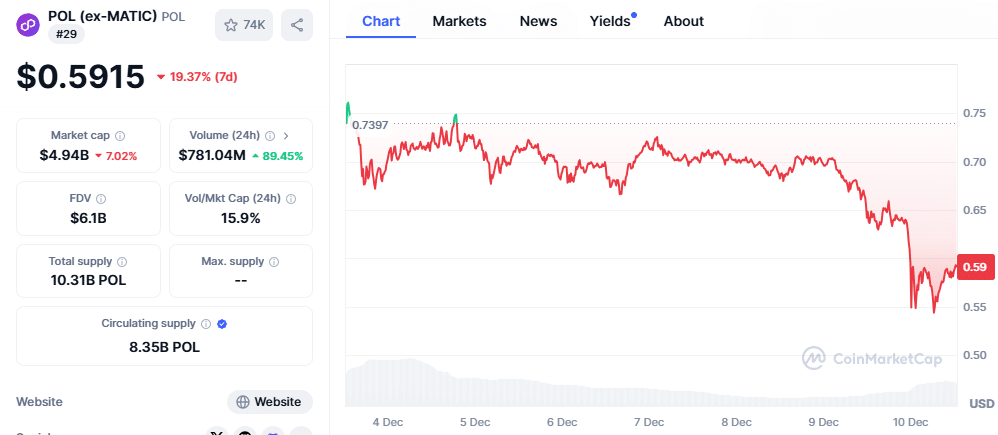

Polygon has experienced a significant uptick in recent weeks, with its price rising by more than 18% last week alone. This surge pushed its market capitalization to $5.9 billion, and as of writing, POL is trading at $0.7063. While this is a substantial drop from its ATH of nearly $2.9, reached in December 2021, the recent upward trend indicates that Polygon might be positioning itself for another potential rally.

Bullish Divergence: A Strong Signal for Price Surge

One of the most notable signals on Polygon’s chart is the appearance of a bullish divergence. A bullish divergence occurs when an asset’s price is declining, but technical indicators like the Relative Strength Index (RSI) indicate increasing buying momentum. This often suggests a reversal in price direction, potentially leading to a rally.

Crypto analyst Javon Marks highlighted that this bullish divergence mirrors a similar pattern seen back in 2021, which led to a major price surge. If history repeats itself, Polygon could see a 300% rally, potentially breaking its previous ATH and driving POL toward new highs. For investors holding or accumulating POL, this could represent significant returns.

The Importance of the Current Price Level

Despite the positive momentum, Polygon‘s current price level remains far below its ATH, presenting a significant hurdle. Reaching or surpassing $2.9 would require sustained bullish momentum and favorable market conditions. At $0.7063, POL still faces an uphill battle to reach its previous highs, but the recent price action suggests that a gradual upward movement could be on the horizon.

Short-Term Outlook and On-Chain Data Analysis

In the short term, on-chain data provides valuable insights into Polygon’s potential. According to Santiment, while the price has been climbing, trading volume has been relatively low. Low volume can signal that the rally may not be sustainable in the long run, especially if larger investors decide to take profits.

The Market Value to Realized Value (MVRV) ratio, a metric that measures the profitability of tokens, has dropped to 37.7%. This suggests that while price increases are occurring, the market is still in an accumulation phase rather than profit-taking. However, data from Glassnode reveals increased realized losses, indicating that some holders may have sold positions at a loss, suggesting a cautious market sentiment.

For traders, there are key price levels to watch. If the bullish momentum continues, the first resistance level is at $0.73, where profit-taking might occur. If sentiment shifts and a correction happens, the next support level to watch is $0.68, which could provide a buying opportunity before a potential rise.

Also Read: Alameda Research Linked Wallet Moves Over 15 Million $POL Tokens as Polygon’s Market Surge Hits 106%

Polygon’s recent bullish divergence and upward momentum have sparked optimism for its future. A breakout could bring the altcoin closer to its ATH or even establish a new high. However, the short-term market activity suggests caution, as further corrections or consolidation may occur. Traders should keep an eye on key technical indicators and support/resistance levels to predict Polygon’s next move. As always, sustained momentum will be key to determining whether POL can break through its ATH or falter.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.