|

Getting your Trinity Audio player ready...

|

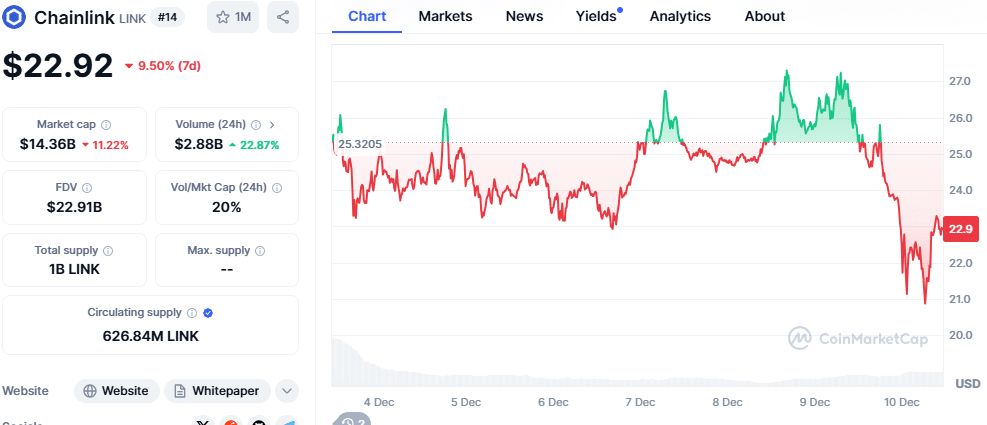

Chainlink (LINK), a leading blockchain oracle network, has recently displayed a promising technical chart pattern that has caught the attention of crypto analysts. The formation of an ascending triangle pattern suggests a potential bullish breakout, indicating that buyers are gradually gaining momentum.

Bullish Signals

- Ascending Triangle Pattern: This technical pattern is characterized by a series of higher lows and a horizontal resistance line. It often signals a period of consolidation before a significant price movement.

- Increasing Volume: Rising trading volumes during recent upward price swings suggest strong buying interest.

- MACD Indicator: The Moving Average Convergence Divergence (MACD) indicator is hovering near the zero line, which could signal an impending bullish crossover.

- RSI Indicator: The Relative Strength Index (RSI) is currently at a neutral level of 52.50, indicating that LINK is not overbought and has room for further upward movement.

Potential Upside

A successful breakout above the resistance level of the triangle pattern could propel LINK’s price towards a target of around $33. This represents a potential upside of over 30% from the current price level.

Cautionary Signals

While the technical outlook for LINK is promising, certain indicators suggest potential downside risks:

- Rising Open Interest: A significant increase in open interest indicates growing market activity and potential volatility.

- Negative Bid-Ask Delta: The negative bid-ask delta suggests that sell orders are outpacing buy orders, which could exert downward pressure on the price.

Chainlink’s bullish triangle pattern and positive technical indicators offer a compelling case for a potential price surge. However, the rising open interest and negative bid-ask delta signal caution. Traders should closely monitor these indicators to gauge the market’s sentiment and potential price movements. A balanced approach, considering both bullish and bearish signals, is crucial for making informed trading decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Chainlink (LINK) Soars 72% in a Day: Is $40 Possible This Week?

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!