|

Getting your Trinity Audio player ready...

|

Hedera Hashgraph’s native cryptocurrency, HBAR, has been on a tear in recent weeks, experiencing a surge in price and demand. This article dives into the recent rally, explores potential signs of a sell-off, and analyzes on-chain data to gauge the coin’s future trajectory.

Impressive Gains: From Oversold to All-Time High

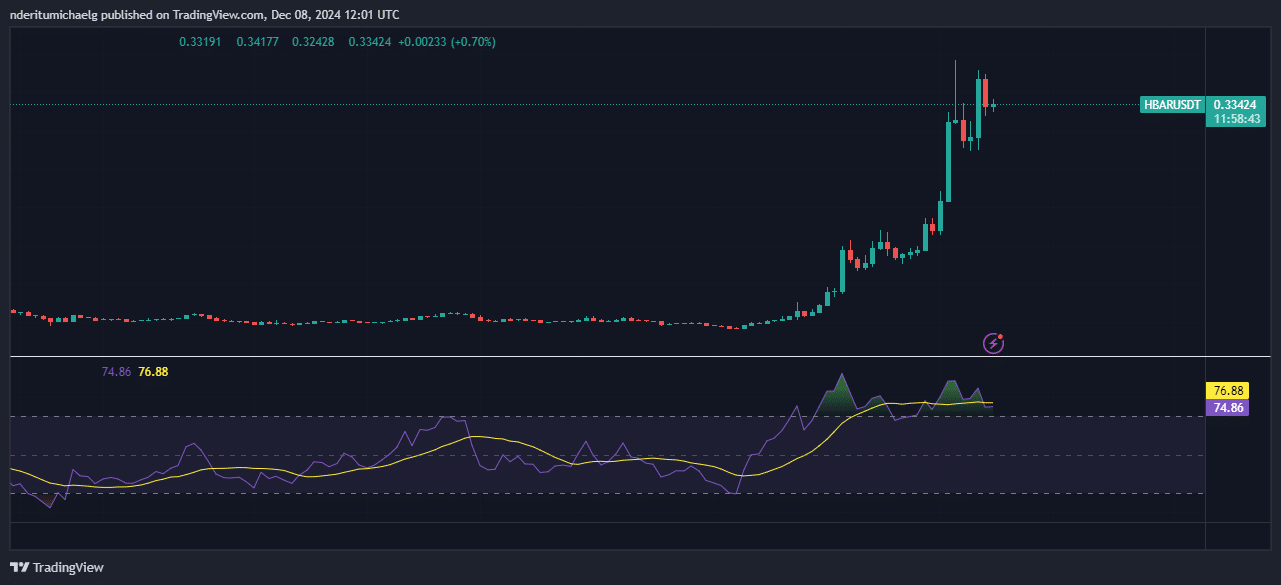

HBAR started November trading near $0.164, but by December 2nd, it had climbed a staggering 136% to a weekly high of $0.392. This impressive rally extends gains to a remarkable 831% from its 2024 low point in November, marking a significant recovery in a short timeframe. Notably, the price reached a new all-time high before closing the week at $0.33.

Is the Bull Run Losing Steam?

While the initial rally was fueled by a spike in spot demand (peaking at $48.22 million on December 2nd), recent market activity suggests a potential shift. Outflows of $8.62 million in the last 24 hours indicate a build-up of sell pressure, likely from traders capitalizing on recent gains.

Open Interest and Funding Rates: Mixed Signals

The derivatives market presents a mixed picture. Open interest, representing outstanding derivative contracts, surged to a new all-time high of $459.87 million on December 8th. This suggests continued investor interest in HBAR, albeit with leverage. Additionally, positive funding rates imply that demand for perpetual contracts is still exceeding supply, mitigating immediate sell pressure concerns. However, a shift towards negative funding rates would signal a potential influx of sellers.

On-Chain Data Hints at Slowing Momentum

On-chain data provides valuable insights into network activity. HBAR‘s on-chain volume, which peaked at a record-breaking $67.59 million on December 3rd, has since dropped significantly. Similarly, Total Value Locked (TVL), reaching a peak of $211.86 million on the same day, has since fallen back. Notably, the decline in TVL when measured in HBAR tokens (from 1.06 billion in mid-November to 594.67 million on December 8th) could suggest lower investor confidence or profit-taking.

The recent decline in on-chain volume and TVL paints a picture of potentially slowing momentum for HBAR. While this doesn’t necessarily spell doom and gloom, it warrants cautious optimism. If demand rebounds, HBAR’s rally could continue. However, sustained sell pressure or a lack of renewed buying interest could lead to a price correction.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Hedera (HBAR) Drops 23%: Can It Stage a Bullish Comeback to Hit $0.393?

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.