|

Getting your Trinity Audio player ready...

|

Last week saw Binance Coin (BNB) bulls flexing their muscles, propelling the cryptocurrency to a 10% weekly surge and reaching a price of $721. This impressive rally positioned BNB with a market capitalization of approximately $104 billion, capturing the attention of the crypto community. However, the bullish momentum was short-lived, as the coin faced a correction in the past 24 hours.

Happy Friday! #Binance Bytes is an initiative by the Research team to provide a quick round-up of the week. Highlights 🧵: pic.twitter.com/lnhlRz5WnF

— Binance Research (@BinanceResearch) December 6, 2024

BNB’s Rally Amid a Greedy Market

According to CoinMarketCap data, BNB’s ascent came during a period of heightened market enthusiasm. Binance Research highlighted notable trends in the crypto space, including a 6% increase in the DeFi sector’s total value locked (TVL) and declining Bitcoin (BTC) dominance. The market’s “extreme greed” phase, reflected in the Fear and Greed Index at a striking 80%, fueled speculative activities across cryptocurrencies, including BNB.

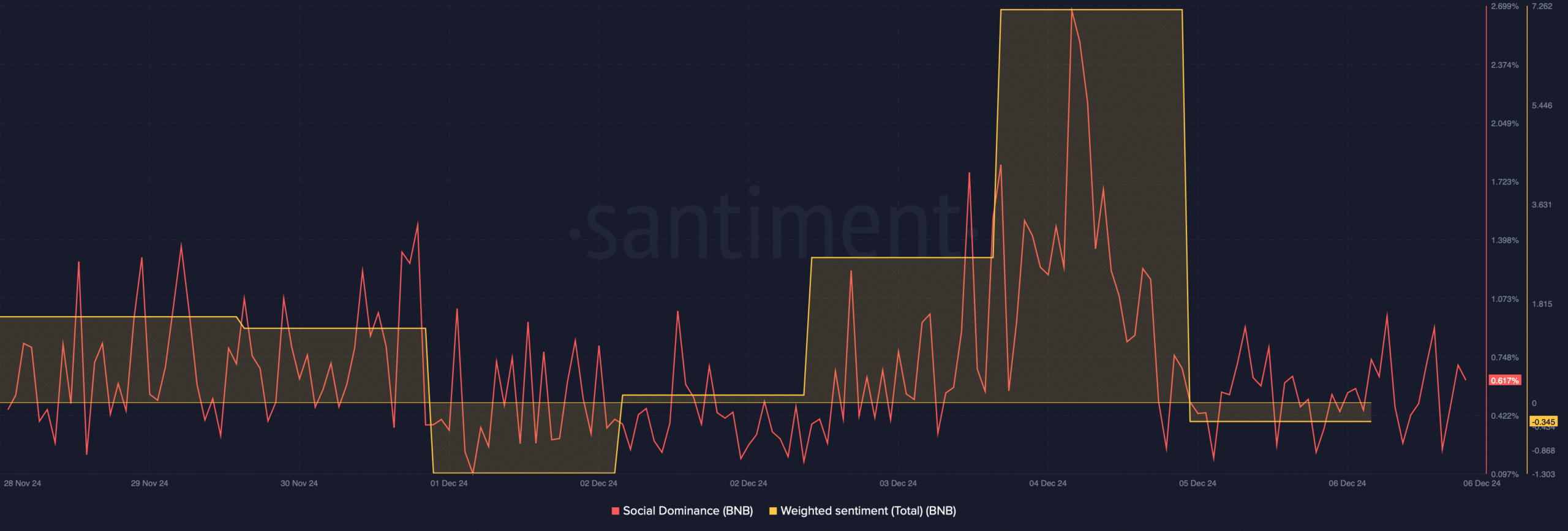

Despite these favorable market conditions, BNB’s price slipped by over 2% in the last 24 hours. This sudden dip coincided with declining social metrics, as BNB’s social dominance waned. Similarly, its weighted sentiment graph suggested rising bearish sentiment, a worrying sign for its short-term outlook.

Will BNB’s Correction Continue?

Analyzing additional data provides mixed signals about BNB’s trajectory. Notably, the coin’s long/short ratio showed an uptick, indicating a growing number of long positions compared to short ones. This development hints at a potential price rebound, as traders bet on a bullish reversal.

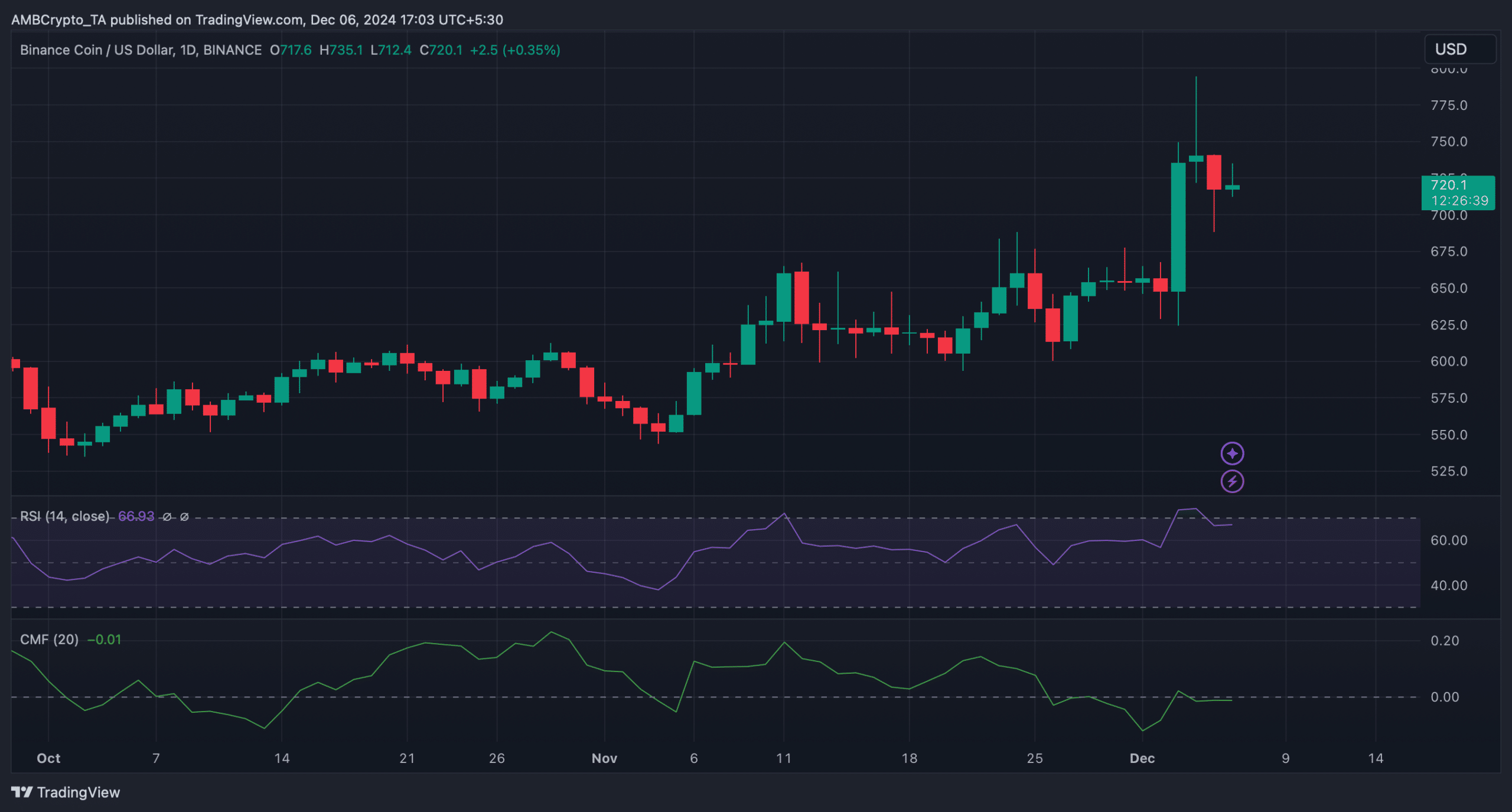

However, challenges remain. BNB’s trading volume has dropped significantly, falling 33% in the past 24 hours. This decline in activity often signals hesitation among investors and could delay a strong recovery. Technical indicators such as the Relative Strength Index (RSI) have also moved southward, while the Chaikin Money Flow (CMF) stayed flat, pointing to weak buying pressure.

Critical Levels to Watch

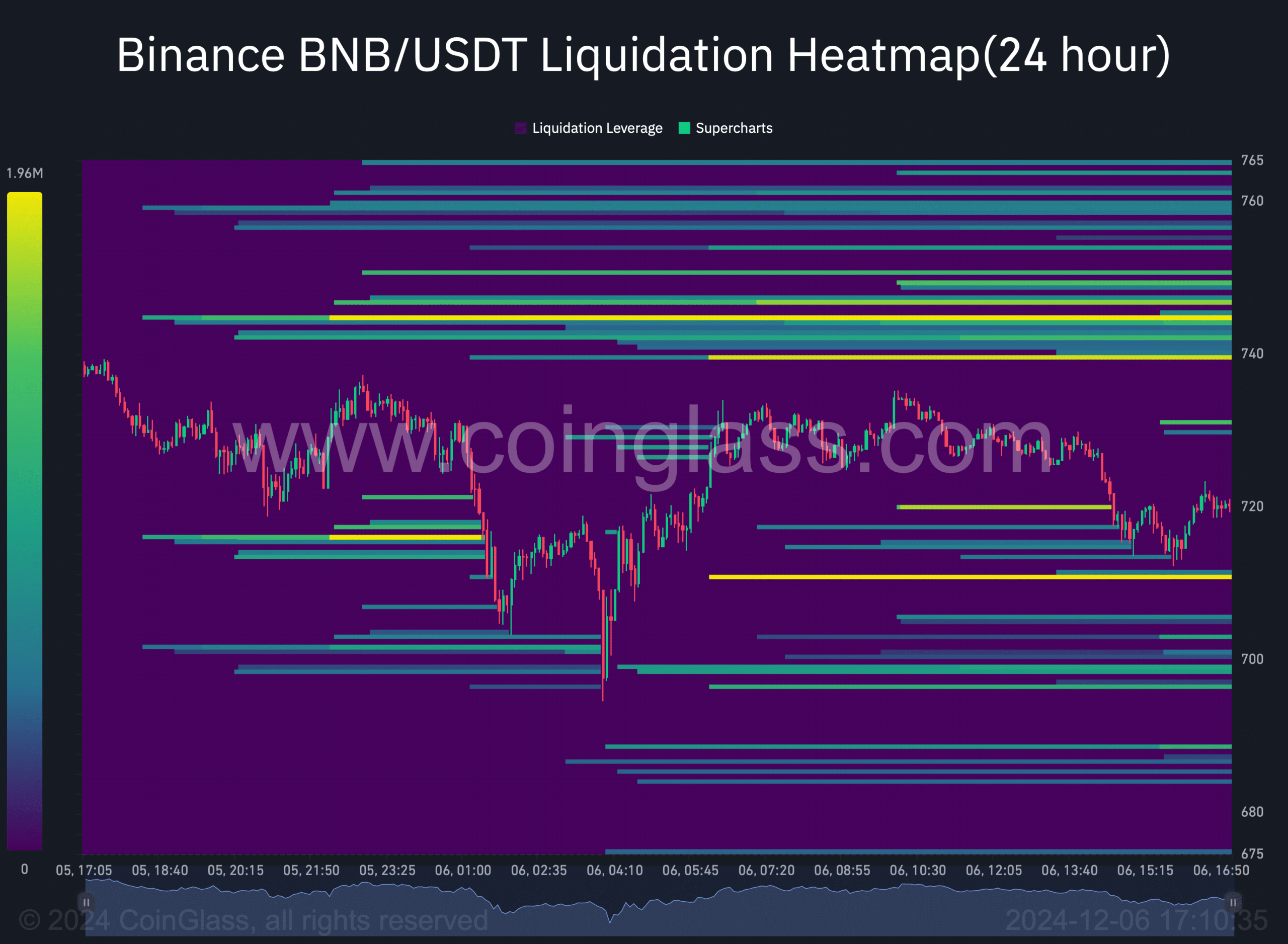

For BNB to regain its upward momentum, overcoming its strong liquidation barrier at $744 is crucial. Liquidations tend to drive price corrections, and surpassing this level could pave the way for higher targets. On the downside, if bearish trends persist, BNB might dip to $710 or lower.

While last week’s rally showcased BNB’s resilience and market relevance, the recent correction underscores the volatility in the crypto space. Investors should keep a close eye on key metrics like trading volume, long/short ratios, and social sentiment to gauge the coin’s next move.

As BNB navigates its current challenges, the coin’s ability to break above its resistance levels will determine whether bulls can stage a comeback or if a prolonged correction is in store.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Terra Luna Classic (LUNC) Rallies Ahead of Major Blockchain Upgrade and Binance Token Burn”

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.