|

Getting your Trinity Audio player ready...

|

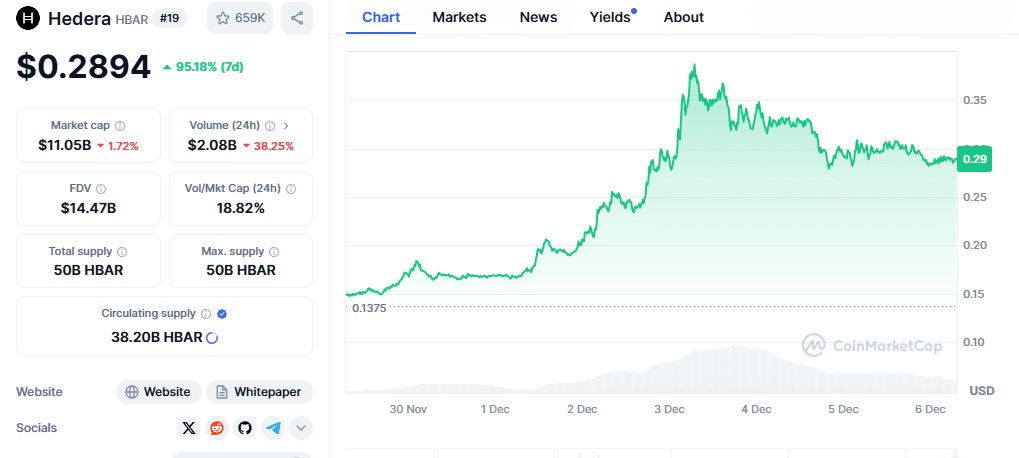

Despite Bitcoin achieving the coveted $100,000 milestone and major altcoins experiencing a remarkable price rally, Hedera (HBAR) has hit a roadblock. The token’s price has struggled to break past its critical resistance level of $0.337, leaving investors wondering: Is Hedera’s dream run over, or is a bullish comeback imminent?

HBAR Faces Bearish Setback Amid Broader Market Optimism

This week, Hedera’s price took a sharp downturn, shedding approximately 7% in the last 24 hours and over 23% across the week. The increase in selling pressure has spooked short-term investors. However, zooming out reveals a different story. HBAR has surged by an impressive 600% over the long term, hinting at the possibility of a reversal in the coming weeks.

The Moving Average Convergence Divergence (MACD) indicator presents a mixed sentiment. While the green histogram shows signs of a decline, the moving averages point toward a significant uptrend on the daily chart. This dual signal highlights the cautious optimism among traders.

Meanwhile, the Simple Moving Average (SMA) has acted as a reliable support line for HBAR since early November, reinforcing the altcoin’s long-term bullish potential.

Key Levels to Watch: Support and Resistance

Hedera’s current support level of $0.278 is crucial for determining its short-term price trajectory. If bulls manage to hold this line, the token could make another attempt to breach the $0.337 resistance level. A successful breakout might propel HBAR toward its 52-week high of approximately $0.393 within December.

Conversely, if bearish momentum persists and HBAR slips below $0.278, the token could retrace further, potentially testing the $0.231 mark. Such a move would signal intensified selling pressure and a short-term bearish outlook.

What Lies Ahead for Hedera?

Despite this week’s bearish reversal, Hedera’s robust long-term growth and technical indicators suggest that a recovery is still possible. Market sentiment, trading volume, and macroeconomic trends in the crypto space will play critical roles in shaping HBAR’s price action in the coming weeks.

For investors looking beyond short-term volatility, Hedera remains a promising project. With its focus on enterprise adoption and sustainable blockchain solutions, HBAR could see renewed interest if the broader crypto market maintains its bullish trajectory.

While Hedera’s recent performance may appear discouraging, the token’s longer-term growth and key support levels offer hope for a rebound. Traders and investors should closely monitor critical price levels and market sentiment as December unfolds. To uncover HBAR’s potential beyond 2023, explore our detailed Hedera Price Prediction to stay ahead of market trends.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.