|

Getting your Trinity Audio player ready...

|

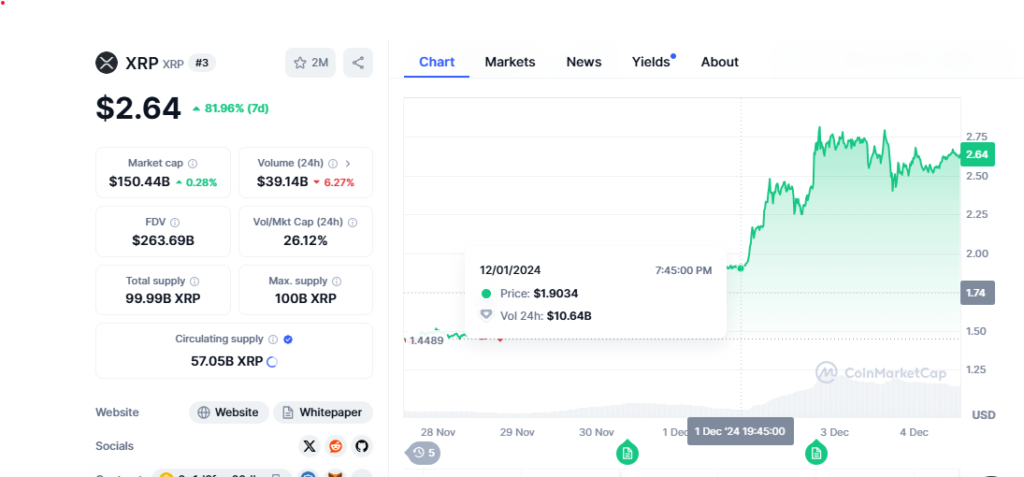

The recent reduction in the XRP reserve fee has ignited speculation about potential price surges for the cryptocurrency.

The fee, which mandates a minimum XRP balance in a wallet, was lowered from 10 XRP to 1 XRP on December 2nd. This decision, driven by community concerns about the previous fee’s impact on adoption, has historical precedent for triggering price increases.

Linda P. Jones, a renowned Wall Street analyst and financial author, highlighted this correlation in her recent commentary. She noted that past reductions in the reserve requirement have often preceded significant price rallies for XRP.

“Historically, reserve fee reductions have been followed by periods of price growth for XRP,” Jones explained. “The cost of the reserve has typically risen to between $4 and $16 after each adjustment.”

For instance, when the reserve fee was reduced from 20 XRP to 10 XRP, XRP’s price subsequently climbed to around $0.50, making the reserve cost $5. Jones believes the latest reduction could set a similar stage for another price surge.

Based on this historical pattern, Jones speculated that XRP’s price could rise to between $4 and $16, which would bring the cost of the 1 XRP reserve fee to the aforementioned range. While this represents a significant potential increase from XRP’s current price of $2.60, it’s important to note that such predictions are inherently speculative and subject to market volatility.

Every wallet that holds XRP has a reserve requirement. It used to be 20 XRP, then it was reduced to 10 XRP. Dec. 2nd it was reduced to 1 XRP. The reserve requirement has usually dropped ahead of an #XRP price increase and has averaged around $4 to $16. Does a drop to 1 XRP imply… pic.twitter.com/h7KMY1jVk3

— Linda P. Jones (@LindaPJones) December 3, 2024

The reduction in the reserve fee is expected to make XRP more accessible to a wider range of users. By lowering the financial barrier to entry, the change could stimulate increased adoption and, potentially, drive further price appreciation.

However, it’s crucial to approach such predictions with caution. Cryptocurrency markets are highly volatile, and a variety of factors can influence price movements. While the historical correlation between reserve fee reductions and price increases is intriguing, it’s not a guarantee of future performance.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.