|

Getting your Trinity Audio player ready...

|

Polkadot’s [DOT] network activity has surged to record-breaking levels, signaling a significant increase in adoption and usage. This surge comes amidst a broader bull market for cryptocurrencies, raising the question of whether Polkadot’s path to $22 is now clear.

A Surge in Network Activity

Token Terminal’s recent data revealed that Polkadot’s monthly transactions have skyrocketed from 20 million to 60 million since the beginning of 2023. This substantial increase, coupled with a rise in daily active addresses, indicates growing interest and engagement within the Polkadot ecosystem.

BREAKING: Monthly transaction count in the @Polkadot ecosystem is at all-time highs.

— Token Terminal (@tokenterminal) December 2, 2024

The monthly transactions have increased from ~20m to ~60m since the beginning of the year. pic.twitter.com/TGe1mbs4JI

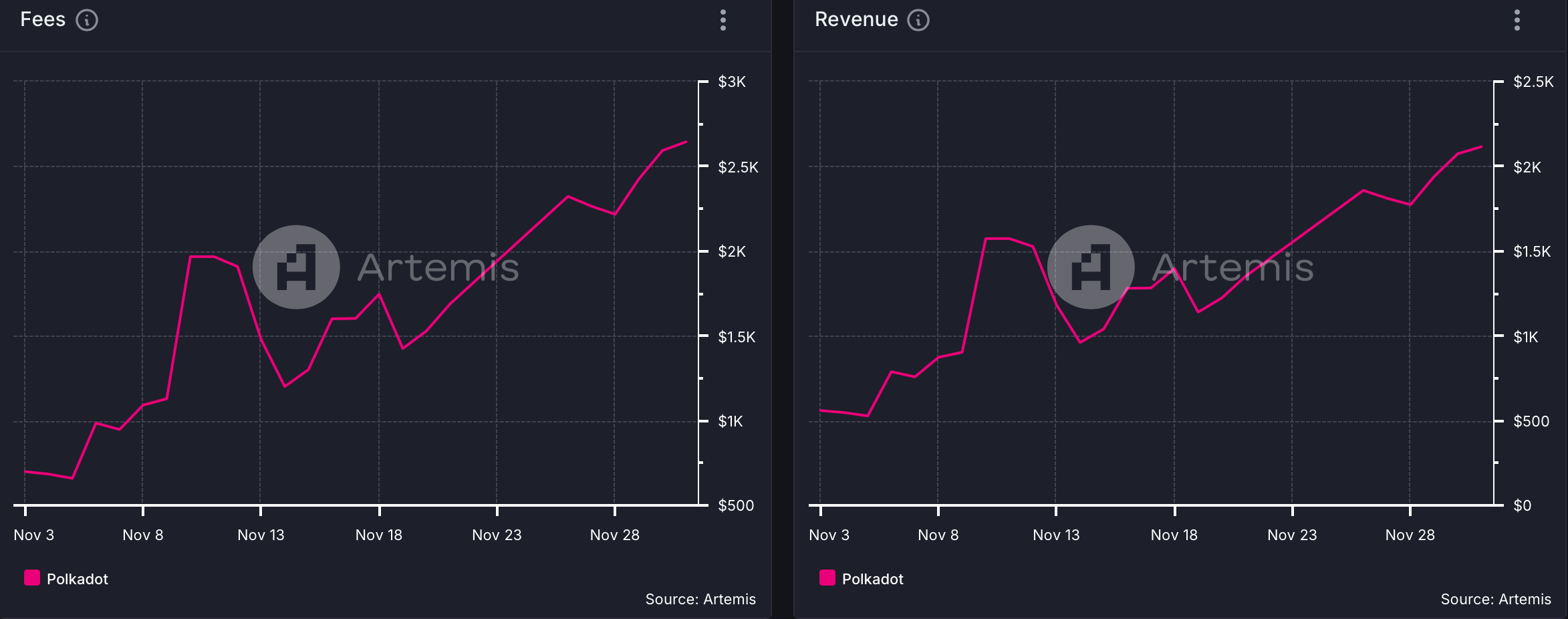

The uptick in network activity has translated into increased fees and revenue for the blockchain. This positive trend suggests that Polkadot is not only attracting more users but is also generating significant value within its ecosystem.

A Bullish Outlook

Polkadot’s recent price performance has mirrored its network activity. The token has experienced a remarkable 25% price surge in the past week, surpassing the crucial resistance level of $10.

Crypto analyst Ali Martinez has expressed optimism about Polkadot’s future trajectory, suggesting that the token could potentially reach $22 in the coming days or weeks. This bullish sentiment is further supported by the increasing trading volume and open interest for DOT, indicating sustained investor demand.

#Polkadot $DOT is sticking to the plan! I think it could now go to $10 or $11, retrace to $7.5, and then $22. https://t.co/OASJfaYiT4 pic.twitter.com/zcBFMiBu8n

— Ali (@ali_charts) December 3, 2024

However, it’s important to note that the cryptocurrency market is inherently volatile. While the current bullish trend is promising, a potential market downturn could impact Polkadot’s price. If bearish sentiment prevails, the token might experience a short-term pullback to $9.5 or even $7.5.

Polkadot’s recent achievements, including the surge in network activity and price appreciation, paint a positive picture for the future of the blockchain. However, investors should remain cautious and conduct thorough research before making investment decisions. As always, it’s essential to consider both the potential upside and downside risks associated with cryptocurrency investments.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.