|

Getting your Trinity Audio player ready...

|

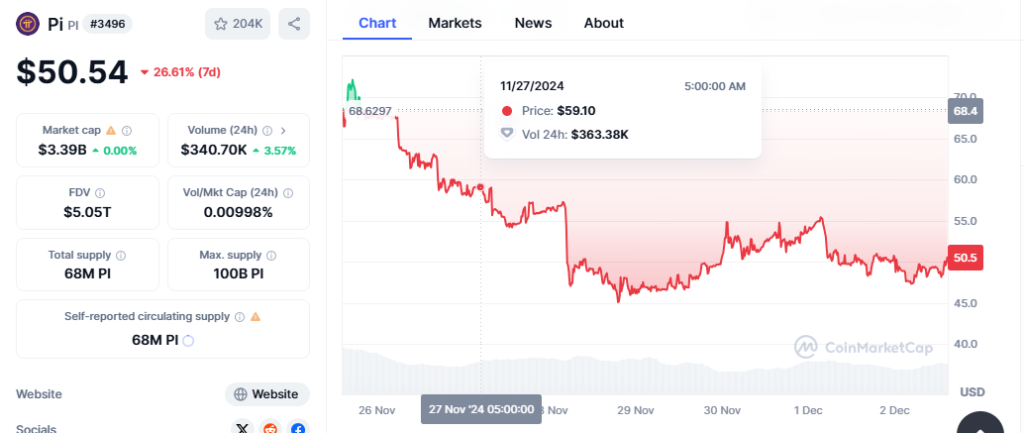

The Pi Network, a digital currency project that has garnered significant attention, is currently experiencing a decline in its token price. Pi Coin, the native token, has witnessed a 50% drop from its November peak, falling to around $48.63. This downturn coincides with the network’s ongoing transition to its open mainnet.

KYC Grace Period Extended – A Double-Edged Sword

One of the primary reasons for the recent price dip is the extension of the Know Your Customer (KYC) verification grace period to December 31st. While this extension affords more users the opportunity to verify their identities, it also delays the anticipated open mainnet launch. The current enclosed mainnet limits Pi Coin’s utility, hindering its potential for growth.

The Path to Open Network – A Gradual Process

Pi Network is steadily progressing towards its open mainnet, with KYC verification being the final major hurdle. The network’s ecosystem is expanding, boasting over 27,000 registered sellers and more than 50 mainnet-ready apps. However, external factors such as U.S. cryptocurrency regulations and broader market volatility could impact the network’s success.

Pi Coin Price Analysis – A Bearish Outlook?

Technically, Pi Coin’s price chart displays bearish signals. The formation of a double-top pattern and the breakdown of the 50-day Exponential Moving Average (EMA) suggest a potential downward trend. Additionally, the bearish pennant pattern indicates a possible price drop to around $37.

A Glimpse of Optimism – A Potential Rebound

Conversely, if Pi Coin finds support above the trendline, a rebound to $65 is conceivable, particularly if market sentiment improves and the open mainnet transition gains momentum.

Also Read: Pi Network Price Under Pressure Amid KYC Grace Period Extension: What’s Next for Pi Coin?

As Pi Network navigates the path to its open mainnet, the future of Pi Coin remains uncertain. The extension of the KYC period, while beneficial for user participation, delays the network’s full potential. Investors should closely monitor network developments and market conditions to make informed decisions. The ultimate trajectory of Pi Coin’s price will depend on the successful completion of the KYC process and broader market dynamics.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.