|

Getting your Trinity Audio player ready...

|

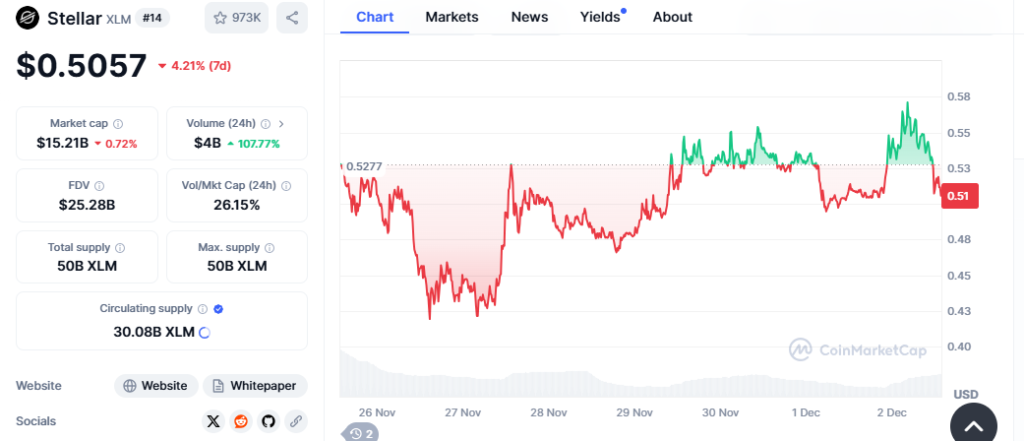

Stellar Lumens (XLM) has demonstrated remarkable resilience, successfully defending the critical $0.40 support level. This price action has ignited hopes for a potential rebound towards its 2021 peak of $0.79.

Technical Analysis – A Cautious Outlook

Technical indicators offer a mixed bag of signals. The Chaikin Money Flow (CMF) metric suggests a stabilization of inflows, potentially setting the stage for a bullish momentum above the $0.40 threshold. However, a recent plateau in these inflows could temper near-term optimism.

The flattening of the CMF since November 20, coupled with declining trading volumes, hints at a potential retest of the $0.40 support level. This development raises concerns about liquidity in the market, as reduced trading activity can amplify price swings.

Whale Exit and Weakening Trend

A significant factor contributing to the current market dynamics is the retreat of crypto whales. These large investors have been exiting their long positions after realizing profits, as evidenced by a negative Whale vs. Retail Delta. This phenomenon typically signals potential price consolidation or a retracement.

The declining Average Directional Index (ADX) from nearly 80 to 21 further reinforces this notion. A reading below 20 indicates an extremely weak trend, prompting caution among swing traders.

The Road Ahead for XLM

While the potential for an extended uptrend remains, the absence of whale activity could prolong the current consolidation phase. Investors and traders are advised to adopt a cautious approach, closely monitoring market conditions for any signs of a decisive directional shift.

In conclusion, XLM’s ability to maintain its position above $0.40 is crucial for its future price trajectory. While a bullish reversal is possible, the current market dynamics, including waning whale interest and a weakening trend, suggest a period of uncertainty. As XLM navigates this critical phase, it is imperative for investors to stay informed and adapt their strategies accordingly.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.