|

Getting your Trinity Audio player ready...

|

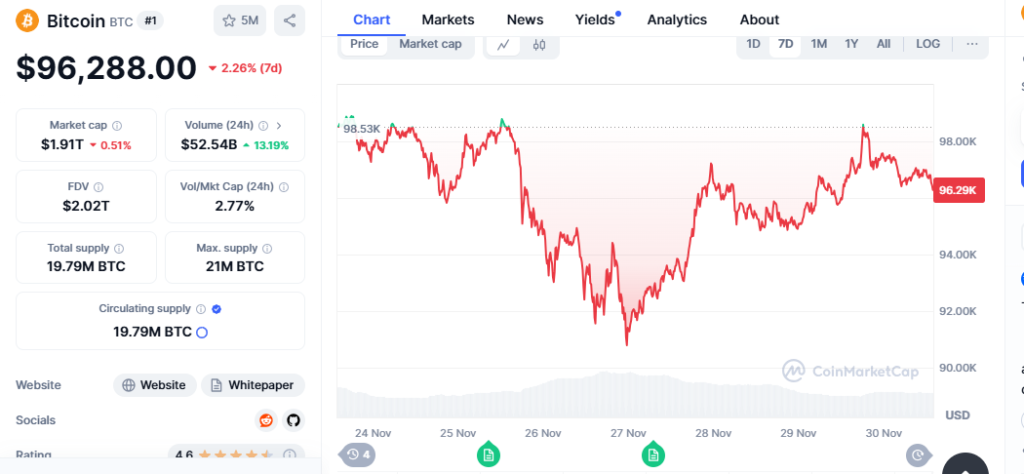

As November draws to a close, all eyes are on Bitcoin (BTC) and its performance on the final trading day of the month. Bitcoin is currently less than 4% away from breaching the psychological barrier of $100,000, a level that many analysts believe is inevitable. With Bitcoin’s impressive rise of over 36% this month, its performance ranks as the fourth-best monthly gain since October 2021, according to CoinGlass data.

Bitcoin’s surge this November is particularly significant, having outpaced all but three previous months—February 2024 (44%), January 2023 (40%), and October 2021 (40%). While this upward momentum has been largely attributed to the surprising outcome of the U.S. presidential election earlier this month, there are still two days remaining until Bitcoin’s official monthly close. These final days could potentially push Bitcoin past even more milestones.

The strong monthly performance follows a solid quarterly performance, with Bitcoin currently up 51% for Q4 2024, on track to finish with a 5% return in December. This marks Bitcoin’s best quarter since Q1, which saw a 69% surge. If current trends hold, it seems less a matter of if Bitcoin will break past the $100,000 mark, but when.

Analyst Insights – Momentum Still Strong

Bitcoin analysts, including Caleb Franzen, suggest there is still more potential for gains in the current bull market. Looking at Bitcoin’s monthly chart and the Relative Strength Index (RSI), Franzen notes that Bitcoin bull markets often peak with an RSI above 90, while the current RSI stands at 75. Historically, bull markets tend to peak with a lower RSI, indicating that the momentum isn’t yet “overheated,” which means more upside could be in store for Bitcoin in the coming months.

This echoes market behavior seen in late 2020, when Bitcoin surged to new heights. Both the Q4 2020 and current market trends have seen strong green months in October and November, followed by a correction. During that period, Bitcoin broke through the $10,000 barrier and climbed to $60,000 by April 2021. The similarities are hard to ignore, and many believe a similar trajectory could play out in the coming months.

On-Chain Data – Bullish Signals

Further supporting the bullish case for Bitcoin is on-chain data from Glassnode, showing that Bitcoin is currently trading above the Short-Term Holder Realized Price (STHRP). This metric is often a strong signal of a bull market, as it shows that Bitcoin is holding above a key support level. In Q4 2020, Bitcoin consistently used the STHRP as support, fueling its price climb.

Moreover, the growing divergence between the realized price and the Long-Term Holder Realized Price (LTHRP) indicates that new participants are entering the market, while long-term holders are taking profits. This dynamic suggests increasing market participation, further supporting Bitcoin’s upward trajectory.

A Milestone on the Horizon

Bitcoin’s journey toward $100,000 is not just a matter of technical indicators—it’s a narrative that spans years. One intriguing data point is that Bitcoin first crossed the $1,000 mark on November 27, 2013, and reached $10,000 just four years later. Could Bitcoin hit $100,000 exactly seven years later? With the current momentum, it’s looking increasingly likely.

As Bitcoin approaches a potentially record-breaking monthly close, all signs point to a continuation of its bullish trend into December and beyond. Whether it’s the final push for $100,000 or the early stages of a new bull cycle, Bitcoin’s future remains as exciting as ever.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.