The crypto market is buzzing with bullish sentiment as Binance, the world’s largest cryptocurrency exchange, announced a fourfold increase in leverage for Terra (LUNA) trading. This move highlights Binance’s continued support for the Terra Luna community, even amidst the fallout from Terraform Labs’ bankruptcy. LUNA, LUNC, and USTC prices have seen notable jumps in response to this update, coupled with broader crypto market enthusiasm.

Binance Amplifies Leverage for Terra (LUNA) Trading

In a significant development, Binance has updated the leverage and margin tiers for the LUNA2USDT perpetual contract. According to the official announcement, the exchange has increased leverage from 11-20x to 51-75x for positions ranging from 0 to 5,000, signaling a strong commitment to bolstering trading opportunities for Terra Luna supporters.

Additionally, Binance has reduced the maintenance margin rates across varying position sizes, enhancing the trading experience for users. The changes extend to other USD-M perpetual contracts, including XEMUSDT, ORBSUSDT, LOOMUSDT, QNTUSDT, CHRUSDT, and JOEUSDT.

The announcement arrives at a pivotal time for the Terra Luna ecosystem, as community-driven initiatives and price recovery efforts gain momentum.

Bullish Momentum for LUNA, LUNC, and USTC

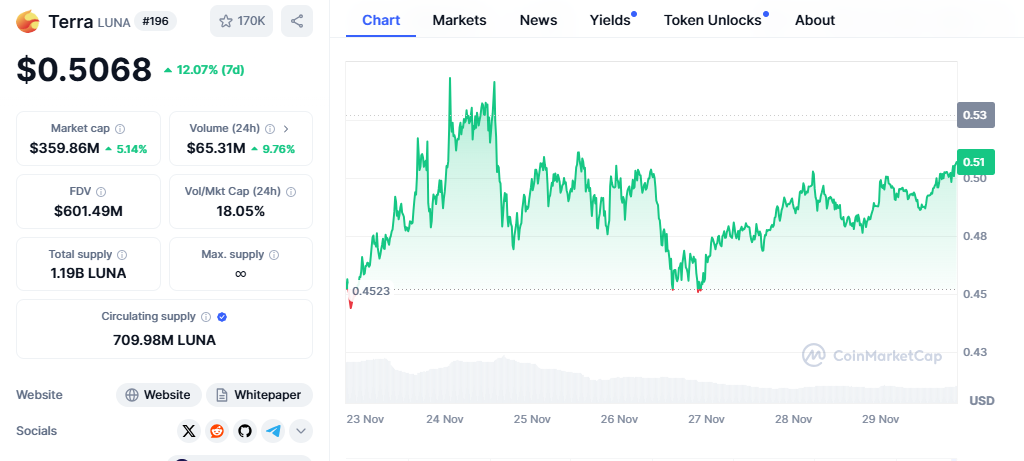

The increased leverage has triggered a wave of bullish activity. Terra (LUNA) is currently trading at $0.502, reflecting a 5% gain over the last 24 hours and an impressive 45% increase in the past month. According to Coinglass data, derivatives trading volumes have surged, demonstrating heightened market participation.

Similarly, LUNC has experienced a 6% daily increase and a 33% jump over the month, with prices reaching $0.0001221. USTC also shows positive movement, gaining 10% in the last month.

Futures trading data reveals growing interest, with total LUNC futures open interest surpassing the 100 billion mark—an over 10% increase within 24 hours. Binance and Bybit futures data show a 9% rise in open interest, underscoring robust buying activity among traders.

Community Push for Token Burns and Recovery

The Terra Luna community remains focused on recovery efforts, advocating for additional token burns from wallets associated with Terraform Labs and the Luna Foundation Guard (LFG). These actions aim to reduce token supply and support price stabilization.]

What’s Next for Terra Luna?

The surge in leverage, coupled with increasing trading activity and community-driven initiatives, sets the stage for potential price rallies in the Terra ecosystem. While Binance’s support is a welcome boost, traders should remain cautious of market volatility, especially with high-leverage trades.

As Terra (LUNA), LUNC, and USTC gain momentum, all eyes are on the broader market dynamics and community efforts to drive further recovery in the wake of past challenges.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.