|

Getting your Trinity Audio player ready...

|

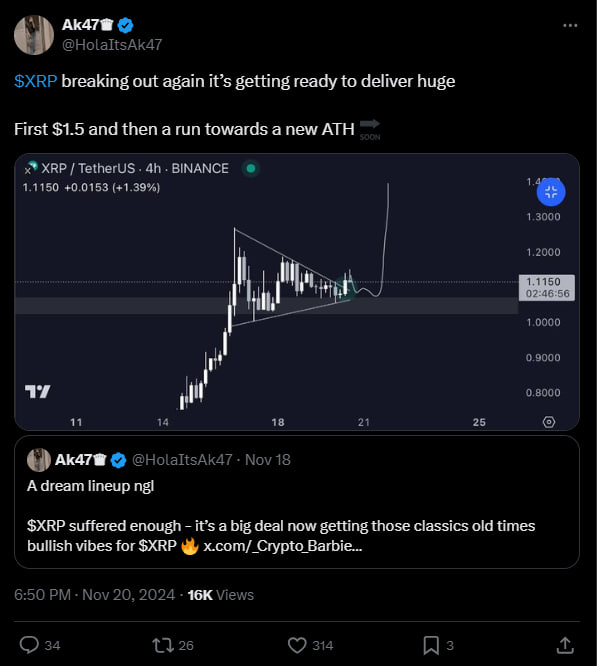

Cryptocurrency markets are buzzing with excitement as XRP, the digital asset associated with Ripple, embarks on a bullish trajectory. The token has recently broken out of a consolidation pattern, indicating a potential for significant price appreciation. With a current price hovering around $1.11, analysts predict an imminent surge towards the $1.5 mark, and possibly even a new all-time high.

Driving The Bullish Momentum

Several factors are contributing to XRP’s bullish momentum:

- Favorable Legal Developments: Ripple’s ongoing legal battle with the SEC has taken a positive turn, with the court ruling that XRP, when sold to retail investors, is not a security. This landmark decision has significantly boosted investor confidence and fueled speculation about a potential settlement or outright victory for Ripple.

- Potential Regulatory Clarity: The possibility of a new SEC leadership, with a more crypto-friendly approach, has further ignited optimism among XRP holders. A favorable regulatory environment could unlock significant value for the token.

- Market Sentiment: The broader cryptocurrency market is experiencing a resurgence, with Bitcoin and Ethereum leading the charge. This positive sentiment has spilled over into altcoins like XRP, attracting new investors and driving up demand.

- Anticipated Ripple Developments: The potential launch of Ripple’s stablecoin and the possibility of an IPO have generated significant buzz within the crypto community. These developments could further solidify XRP’s position in the market.

Technical Analysis

Technical analysts are closely monitoring XRP’s price action. The recent breakout from a consolidation pattern suggests strong buying pressure and a potential for a sustained uptrend. Increased trading volume and positive net inflows further support this bullish outlook.

While XRP’s future remains uncertain, the current bullish momentum and positive market sentiment have created a favorable environment for the token. However, investors should exercise caution and conduct thorough research before making any investment decisions. As always, it is crucial to 1 diversify your portfolio and manage risk effectively.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.