|

Getting your Trinity Audio player ready...

|

Cardano (ADA), the native token of the Cardano blockchain, is emerging as a standout performer in the cryptocurrency market. While many altcoins (alternative cryptocurrencies) are simply mirroring Bitcoin’s recent price surge, Cardano is charting its own course with impressive growth. This independent momentum has investors excited about ADA’s potential, particularly as its price approaches an 8-month high.

Standing Out In The Crowd

It’s uncommon for an altcoin to exhibit such strong independent price action. While Bitcoin is undoubtedly dominating the headlines, ADA has been steadily climbing in value. Notably, both ADA’s price and its pairing with Bitcoin (ADA/BTC) are currently at levels not witnessed in over 8 months. The last time Cardano experienced a similar surge was back in June, shortly before a significant 26% rise against Bitcoin. This historical precedent could signal a promising period for Cardano holders.

Whale Activity on the Rise – A Sign of Confidence

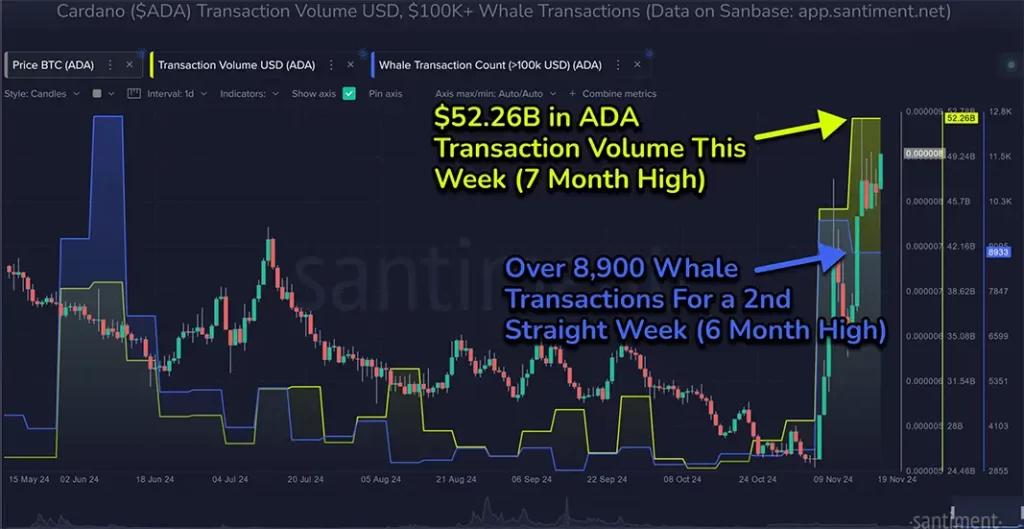

One of the most intriguing developments surrounding Cardano is the recent spike in whale activity. Over the past two weeks, there have been more than 8,900 whale transactions, a level unseen in months. These large-volume transactions often indicate confidence among major investors, and this surge in activity suggests that Cardano’s price movements are attracting significant attention.

Complementing the whale activity is Cardano’s impressive trading volume, which reached a staggering $52.26 billion this week. This high volume signifies that Cardano isn’t just attracting whales; it’s garnering broader investor interest across the board.

Technical Analysis Paints a Bullish Picture

On November 8th, Cardano broke free from a downward price channel that had been restricting its movement for some time. This technical breakout is a strong indicator that ADA may be poised for further upward momentum in the near future. Examining technical indicators like the Relative Strength Index (RSI) for ADA/BTC, which currently sits at 73.45, suggests that the market might be slightly overbought. However, this shouldn’t necessarily be interpreted as a bearish signal – there could still be room for growth before hitting a ceiling. Additionally, the balance of power indicator, currently at 0.50, suggests a relatively balanced market, which could pave the way for exciting price shifts in the coming days.

Cardano – A Force to Be Reckoned With?

With Bitcoin’s continued dominance and its own independent growth potential, Cardano is undoubtedly a cryptocurrency to keep a close eye on. The surge in whale activity, robust trading volume, and positive technical indicators all point towards the possibility of Cardano building upon its recent success. Whether you’re a seasoned investor or simply following the ever-evolving crypto landscape, Cardano could be gearing up for significant developments in the months ahead.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.