|

Getting your Trinity Audio player ready...

|

Despite Bitcoin’s recent price surge, market indicators are raising concerns about its ability to reach the coveted $70,000 mark. While the cryptocurrency has temporarily breached the $63,000 level, a closer examination of on-chain metrics reveals potential roadblocks.

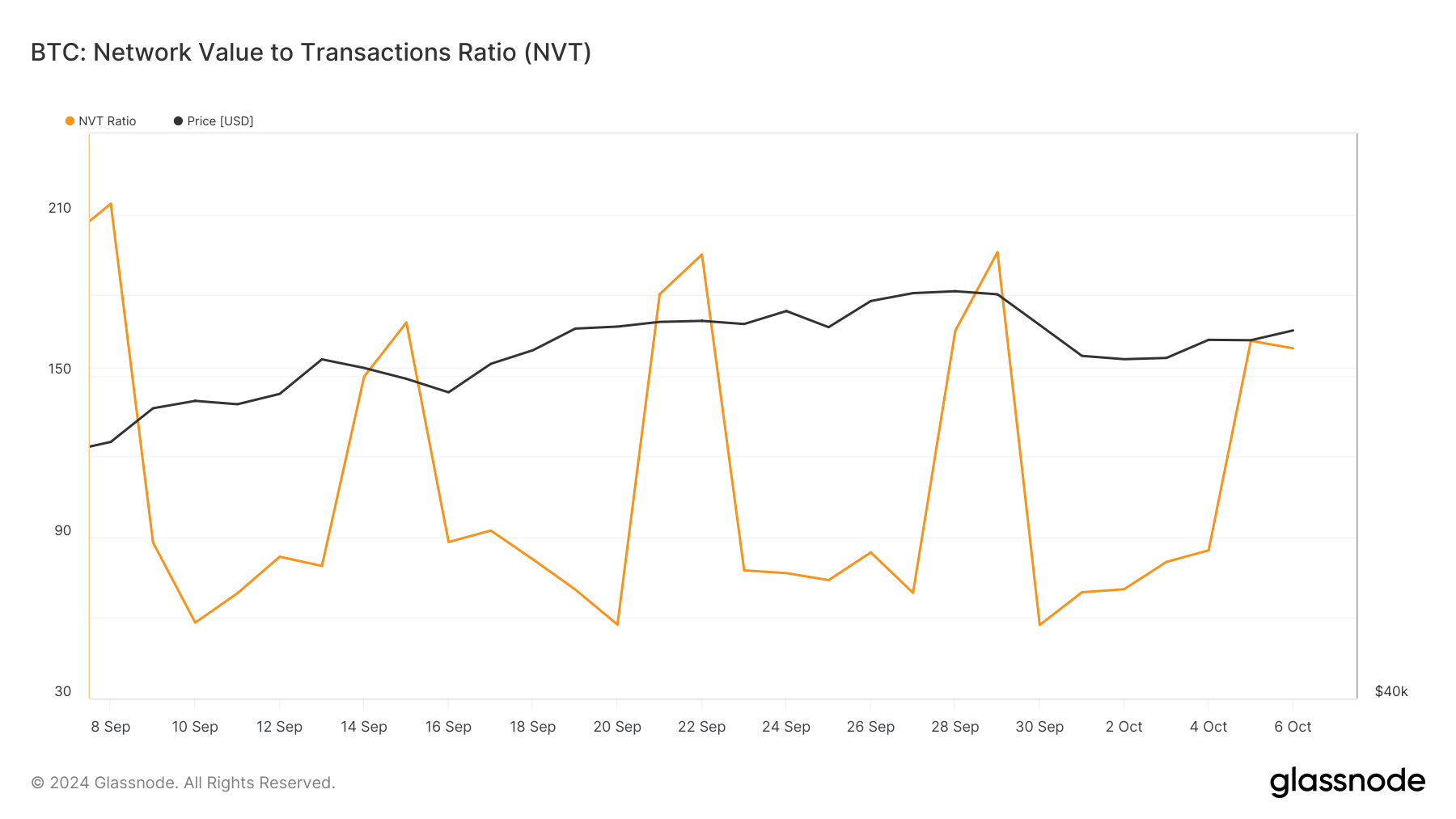

One such indicator, the Network Value to Transactions (NVT) ratio, suggests that Bitcoin’s market cap is growing faster than its transaction volume. A rising NVT ratio often indicates potential overvaluation, suggesting a possible short-term price correction.

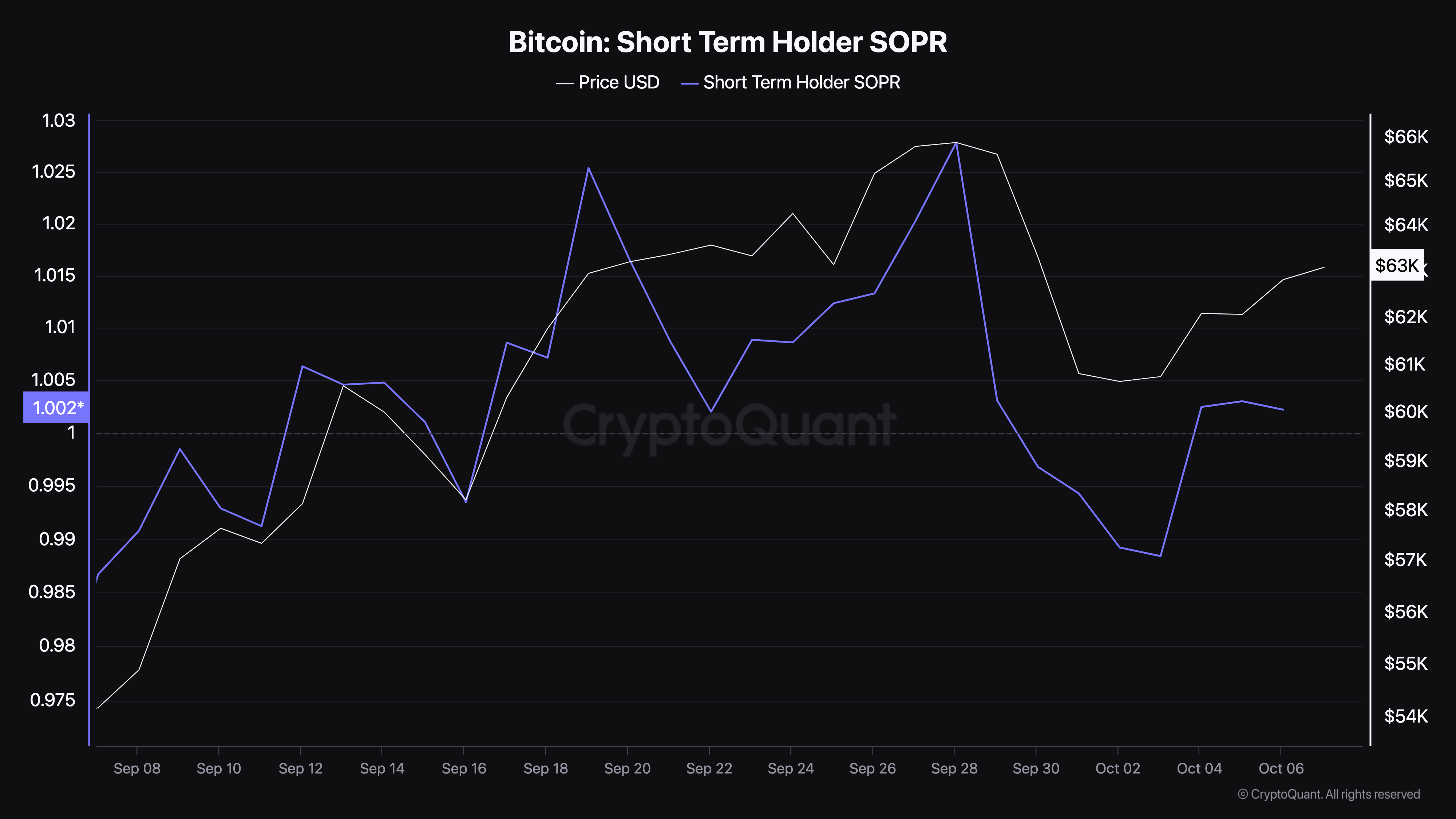

Additionally, the Short-Term Holder-Spent Output Profit Ratio (STH-SOPR) shows that short-term investors are selling at a profit and a loss in equal measure. This suggests a lack of clear direction and could hinder Bitcoin’s upward momentum.

Technical analysis also paints a mixed picture. While Bitcoin’s price has increased on the daily chart, the Money Flow Index (MFI) indicates that capital inflow has been declining. This suggests that investors might be taking profits, which could cap the price increase.

If the MFI continues to fall, Bitcoin’s price could potentially retrace to $59,978. However, a sustained accumulation by investors could propel the price towards $66,527 and eventually $70,000.

Also Read: IMF Pressures El Salvador To Reform Bitcoin Law As 70% Of Citizens Remain Skeptical

In conclusion, while Bitcoin’s recent price surge is encouraging, investors should exercise caution. The combination of on-chain metrics and technical indicators suggests that the path to $70,000 may be fraught with challenges. A sustained increase in investor confidence and a shift in market sentiment will be crucial for Bitcoin to overcome these hurdles.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!