|

Getting your Trinity Audio player ready...

|

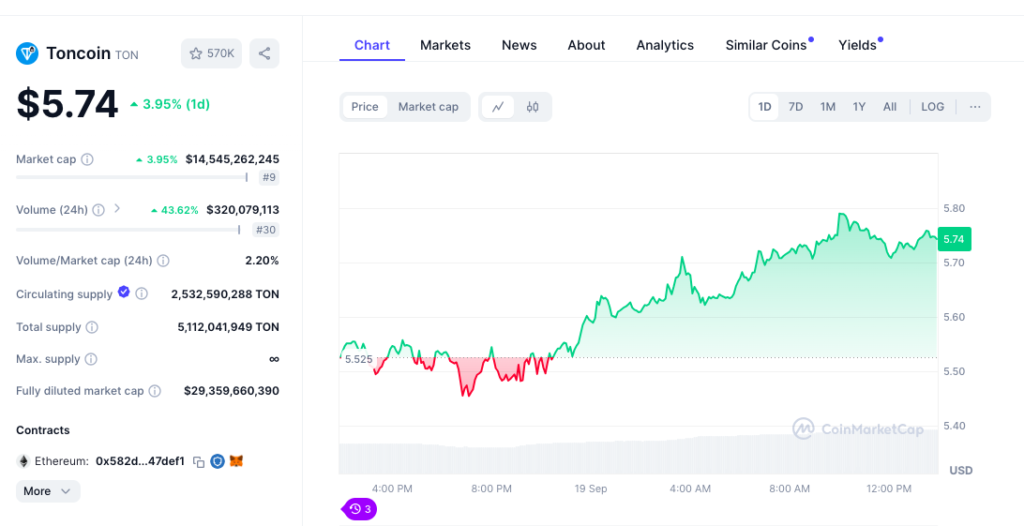

Toncoin (TON) is poised to break through the critical psychological price level of $6.00, backed by strong market momentum. However, while reaching this milestone seems achievable, further upside may be limited due to potential resistance at higher levels.

Bullish Outlook with Key Resistance

Toncoin’s current price trajectory suggests a strong likelihood of surpassing the $5.93 barrier. The In/Out of the Money Around Price (IOMAP) data reveals minimal buying pressure at this level, indicating weak resistance.

On the other hand, the support zone between $5.48 and $5.65 is significantly stronger, with approximately 628 million TON purchased within this range. This suggests that this zone will act as a solid floor in case of a price pullback.

Waning Investor Confidence

Despite the bullish outlook, a decline in active addresses on the Toncoin network raises concerns about investor confidence. The number of active addresses has decreased by 31% in the past 11 days, from 3.5 million to 2.4 million. This suggests that some investors may be pulling back due to fears of volatility, potentially slowing down Toncoin’s rally.

Also Read: Toncoin (TON) – Death Cross Sparks Debate—Will Price Hit $6.82 Or Plunge To $4.46?

Price Prediction

Toncoin is currently trading at $5.74, aiming to break above the key resistance level of $5.96. If successful, TON could rise to $6.00, marking a near-monthly high. However, breaking past the next resistance at $6.36 may prove challenging.

If Toncoin fails to break above $5.96, it could revert to a consolidation phase above the critical support floor of $5.49, limiting further upward movement.

While Toncoin’s bullish momentum is strong, the potential for resistance at higher price levels and waning investor confidence could limit its upside potential. The upcoming days will be crucial in determining whether TON can successfully break through the $6.00 barrier and continue its upward trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!