|

Getting your Trinity Audio player ready...

|

Pepe (PEPE) has resumed its downward trend following a brief bullish surge in late August. The memecoin’s price has been closely correlated with Bitcoin (BTC) and other major meme coins, particularly Shiba Inu (SHIB), making it difficult to break free from the broader bearish market sentiment.

Network Activity Signals Trouble

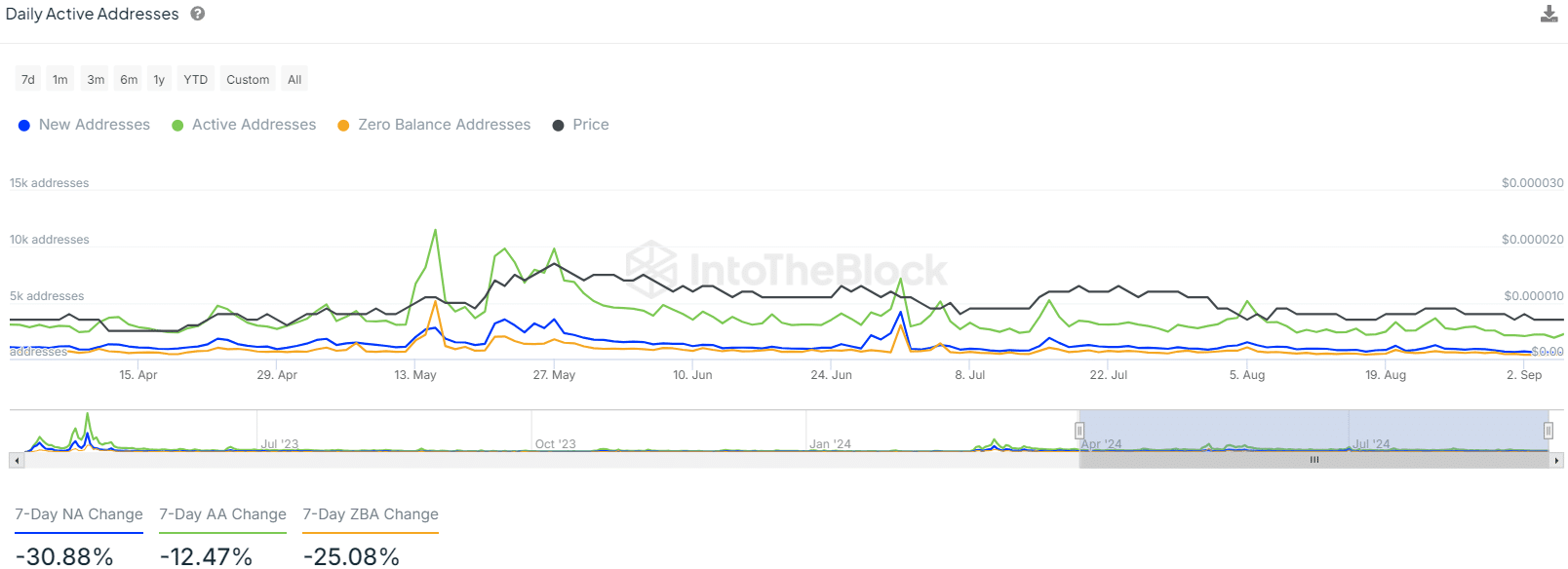

An analysis of Pepe’s network activity has revealed concerning signs. The number of daily active addresses and new addresses has declined significantly in recent weeks, indicating a decrease in user engagement and adoption. This trend has persisted over several months, with the number of active addresses falling from a high of 9.85k in May to its current value of 2.22k.

While a decline in zero-balance addresses typically indicates increased network health, in Pepe’s case, this positive signal is overshadowed by the negative trends in other network metrics. Additionally, the number of addresses holding Pepe in the short-term has decreased, suggesting a lack of interest from traders.

Liquidity Targets and Potential Reversal

Despite the bearish outlook, there is still potential for a price reversal. The liquidation heatmap shows that the $0.00000588-$0.00000619 zone is a key liquidity target for September. If Pepe revisits this zone, it could trigger a trend reversal and provide a buying opportunity for investors.

Also Read: Pepe Coin Price on Edge – NFP Report Could Trigger a 27% Rally or 26% Plunge

However, the success of this potential reversal depends on Bitcoin’s price and overall market sentiment. If Bitcoin continues to decline and the broader market remains bearish, it may be difficult for Pepe to overcome the downward pressure.

Pepe is currently facing a challenging period, with bearish market conditions and declining network activity weighing on its price. While there is potential for a reversal, the memecoin’s future outlook remains uncertain. Investors should closely monitor Bitcoin’s price and Pepe’s network metrics for any signs of improvement.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!