|

Getting your Trinity Audio player ready...

|

The price of Terra Luna Classic (LUNC) has experienced a decline in the past 24 hours, following recent developments within the community. These developments include allegations of a validator violating network rules and the disclosure of a significant LUNC holding by a prominent Bitcoin investor.

A LUNC community member has accused the JESUSisLORD 2 (JIL2) validator of breaking the network’s Dynamic Commission (dynComm) rule by creating a second validator under the same entity. This action, they claim, is a deliberate attempt to fragment voting power and maintain lower commission rates.

While the LUNC community is divided on the severity of the alleged violation, there is consensus that it raises concerns about decentralization and fairness. The dynComm rule was introduced to prevent the concentration of power within the network, but the loophole exposed by the JIL2 validator highlights a flaw in its design.

To address this issue, the community member has proposed a governance proposal to close the loophole and prevent future occurrences. The proposal suggests using the community’s legislative and judicial-like powers to implement necessary changes.

Also Read: Terraform Labs Issues Final Warning to Terra Classic Users – Act Now to Save Your LUNC and USTC

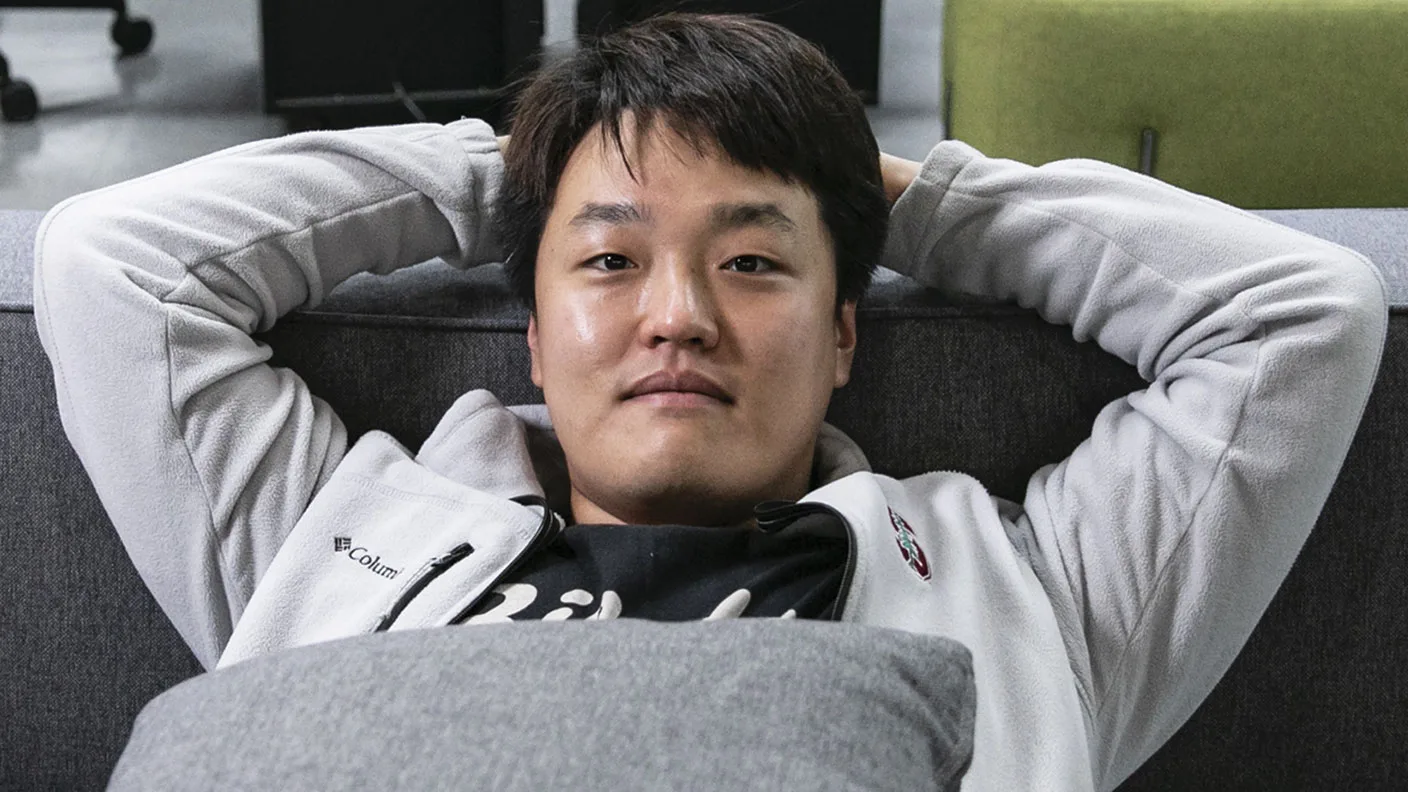

In related news, prominent Bitcoin investor Vasil has revealed that he holds 40 billion LUNC tokens. This disclosure has sparked discussions within the crypto community, with some expressing excitement about his support for the project and others raising concerns about the potential impact of his large holding on market dynamics.

Vasil’s support for LUNC comes at a time when the project is still recovering from the devastating crash of May 2022. The community has been working tirelessly to revive the project and restore its value. The disclosure of a significant whale holding could provide a boost to LUNC’s price and attract more investors.

However, the recent decline in LUNC’s price suggests that the project still faces challenges. The validator controversy and the potential impact of Vasil’s large holding are factors that could influence the project’s future trajectory. As the LUNC community continues to navigate these challenges, investors will be watching closely to see how the project evolves.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!