|

Getting your Trinity Audio player ready...

|

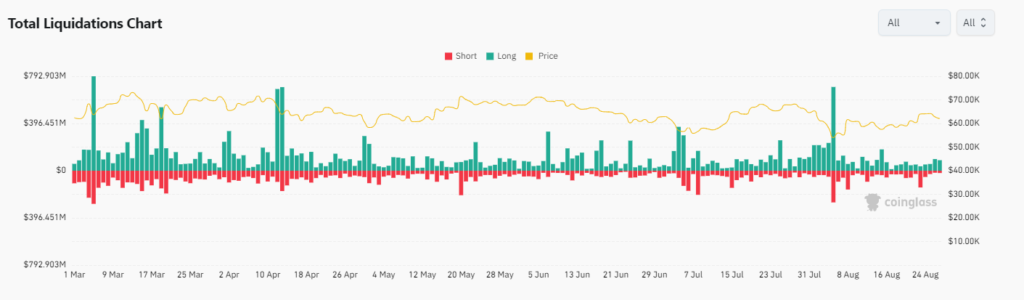

The Bitcoin (BTC) market has experienced a significant liquidation wave in recent days, with bullish traders bearing the brunt of the losses. According to Coinglass, over $3 million worth of long positions were liquidated in just one hour, while short liquidations totaled a mere $51,000. This stark imbalance, representing a 7,023% difference, clearly indicates a prevailing bearish sentiment in the market.

The price of Bitcoin has declined by 0.6% over the same period, contributing to the liquidation spree. This drop follows a 3.7% decline since the beginning of the week, further exacerbating the pain for bullish traders.

Leveraged Trading and Risk Management

The recent liquidations highlight the risks associated with leveraged trading. Those who were late to the game or failed to manage their risk effectively have suffered significant losses. The question now is whether this is simply a normal correction or the beginning of a more extended downtrend.

Investor Interest and Future Outlook

Despite the recent volatility, Bitcoin remains a major player in the financial markets. Investors and traders continue to pay close attention to the cryptocurrency, recognizing both the opportunities and risks it presents.

Also Read: Bitcoin (BTC) Outperforms Ethereum Amidst Market Downturn – ETH Face Surging Withdrawal Pressure

While the liquidations may dampen the enthusiasm of some, others may see this as an opportunity to buy Bitcoin at a potentially discounted price. However, it’s important to remember that leveraged trading carries significant risks, and traders should exercise caution and consider their risk tolerance before entering into such positions.

The Bitcoin market has experienced a wave of liquidations, primarily impacting bullish traders. The bearish sentiment and recent price decline have contributed to these losses. While the future outlook for Bitcoin remains uncertain, investors should be aware of the risks associated with leveraged trading and make informed decisions based on their individual risk tolerance and market analysis.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.