|

Getting your Trinity Audio player ready...

|

PEPE, the third-largest meme coin in the cryptocurrency market, is poised for a significant rally as it retests a bullish double-bottom price action pattern. This positive technical formation, coupled with the recent interest rate cut announcement, has created a favorable environment for PEPE to gain momentum.

Technical Analysis and Price Targets

Following a bullish breakout on August 24, PEPE’s price closed above the neckline of the double-bottom pattern. This retest of the neckline is seen as a bullish signal, indicating potential upside movement.

Price action experts are predicting a 40% increase in PEPE’s value, potentially reaching the $0.0000128 level in the coming days. The double-bottom pattern is often associated with significant price rallies, and PEPE’s current technical setup suggests that a similar scenario could unfold.

Liquidation Risks and On-Chain Analysis

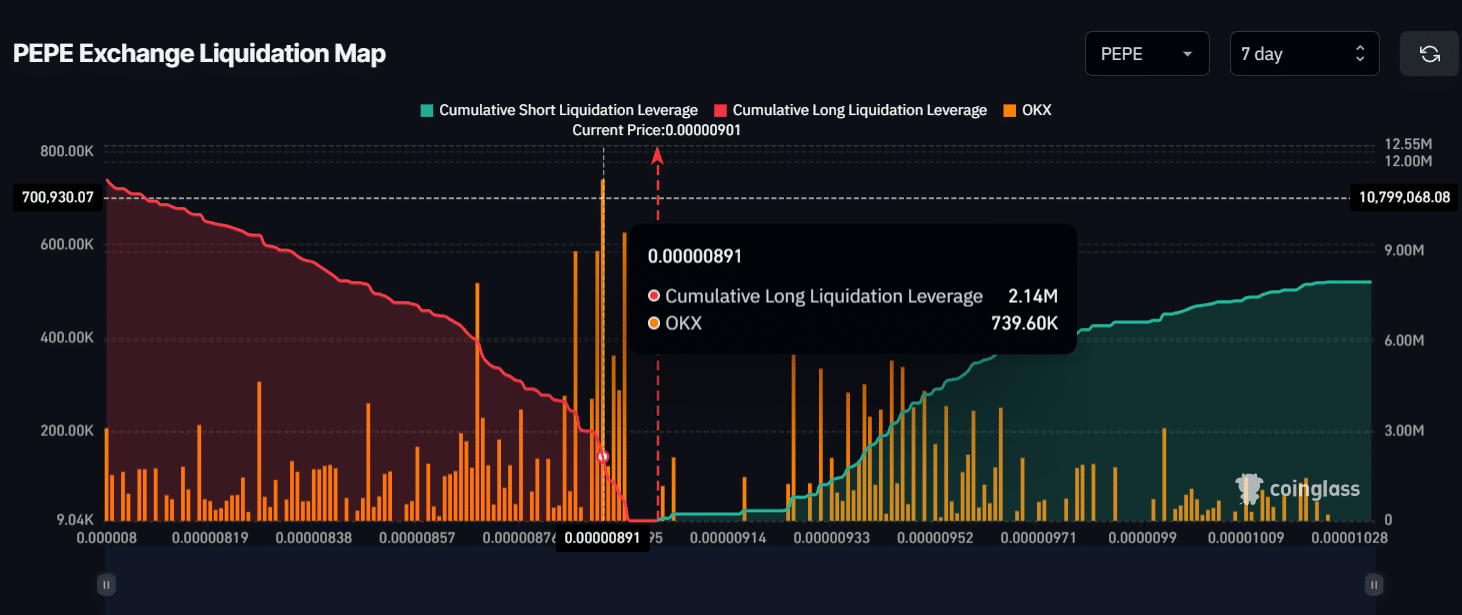

While the overall sentiment for PEPE is bullish, it’s important to note that traders are highly leveraged on long positions, as revealed by CoinGlass data. The key liquidation levels are currently around $0.00000891 and $0.00000926. If PEPE’s price reaches these levels, significant liquidations could occur, potentially impacting market sentiment.

On-chain analysis firm IntoTheBlock’s Historical In/Out of the Money indicator shows that 67.69% of PEPE holders are currently profitable, while 23.11% are at a loss. This suggests that a majority of investors are optimistic about PEPE’s future.

Also Read: Pepe Coin (PEPE) Shows Potential for 10x Growth, Mimicking Bitcoin’s Early 2023 Surge

Challenges in the Meme Coin Sector

Despite PEPE’s bullish outlook, it’s worth noting that the overall meme coin sector is facing some challenges. Top meme coins like Dogecoin, Shiba Inu, Dogwifhat, and Bonk have experienced slight declines in the past 24 hours. This indicates that broader market sentiment may be influencing the performance of these assets.

As PEPE continues to navigate the cryptocurrency market, investors will be closely watching its price action and the potential impact of liquidations on its momentum. The double-bottom pattern and bullish sentiment suggest that PEPE could be positioned for a significant upward move, but the challenges within the meme coin sector may introduce some volatility.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.