|

Getting your Trinity Audio player ready...

|

Ethereum (ETH) has been exhibiting signs of a potential recovery in recent weeks, with several key indicators pointing towards a bullish outlook. One of the most notable developments is the surge in the taker buy/sell ratio, which has risen significantly over the past couple of days.

Taker Buy/Sell Ratio Indicates Bullish Sentiment

The taker buy/sell ratio is a metric that tracks the volume of market buy orders relative to sell orders. When this ratio is above 1, it indicates a bullish sentiment, as more traders are willing to pay a premium to buy ETH rather than sell.

Outflow of ETH from Exchanges Suggests Accumulation

Another positive sign is the recent outflow of ETH from exchanges. This suggests that investors are accumulating the cryptocurrency, potentially anticipating a price increase. The 14-day simple moving average has also resumed its uptrend, further reinforcing the bullish outlook.

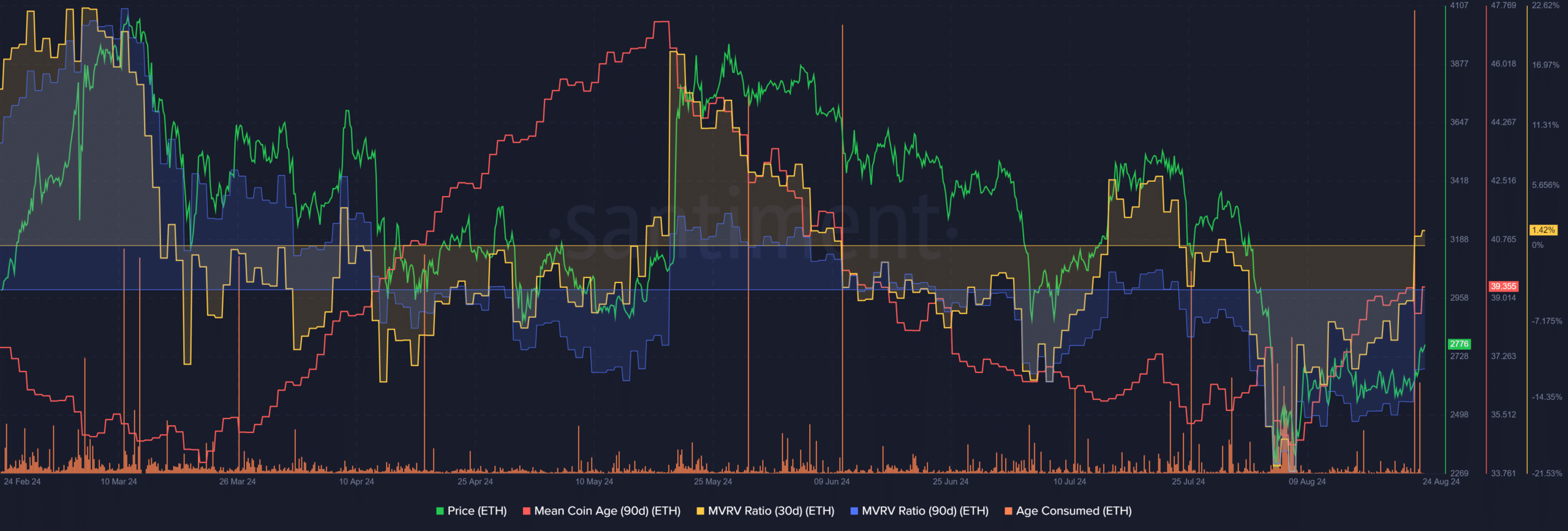

The 30-day MVRV, which measures the average profit or loss for short-term holders, has entered positive territory. This indicates that many short-term holders are currently in profit, which could provide support for the price.

Network-Wide Accumulation

The mean coin age metric has been trending higher, suggesting that ETH is being held for longer periods. This is another bullish sign, as it indicates that investors are accumulating the cryptocurrency rather than selling it.

Cautionary Notes

However, it’s important to note that the 90-day MVRV remains deeply negative, indicating that long-term holders are still at a loss. Additionally, the surge in the age-consumed metric suggests increased token movement, which could be a sign of potential selling pressure.

Furthermore, the recent drop in network gas fees could lead to inflationary pressures in the ETH supply over time, which could negatively impact the price.

Also Read: Ethereum’s (ETH) Dencun Upgrade – 41.6% Transaction Failure Rate For High-Activity Bots

While the overall indicators suggest a bullish outlook for Ethereum, traders should remain cautious and be aware of potential risks. The market remains volatile, and there is a possibility of a pullback in the short term. However, if the positive trends continue, Ethereum could be poised for a significant price increase.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!