|

Getting your Trinity Audio player ready...

|

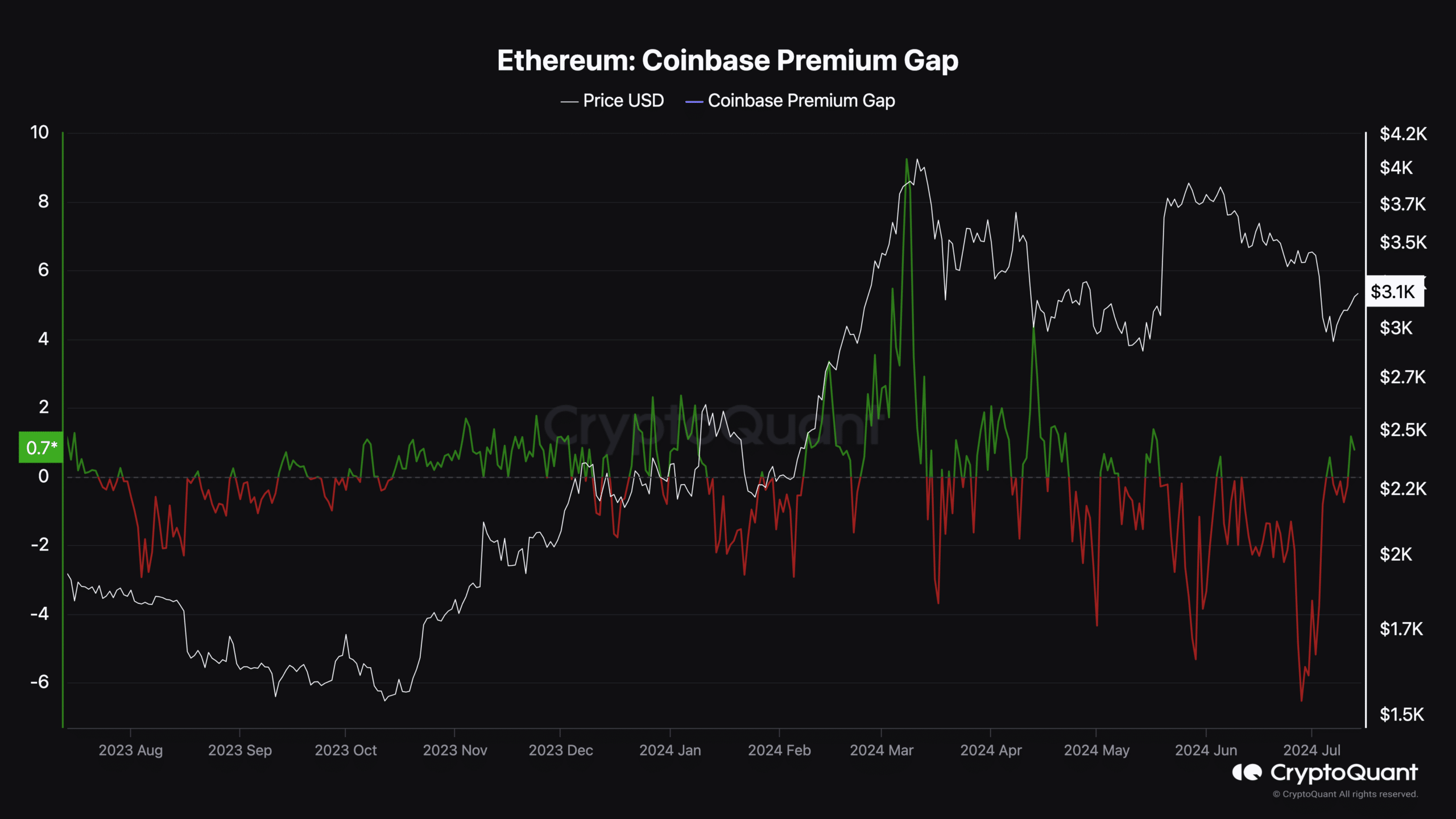

Ethereum (ETH), the world’s second-largest cryptocurrency, is showing signs of a resurgence driven by renewed buying pressure, particularly from investors in the United States. This trend is evident in the rising Coinbase Premium Gap, a metric that measures the difference between ETH’s price on the American exchange Coinbase and its global counterpart, Binance. Historically, a narrowing gap indicates increased buying activity from US investors.

Coinbase Premium Gap Hints at Bullish Ethereum ETF Impact

According to data from CryptoQuant, the recent rise in the Coinbase Premium Gap to 0.78 suggests strong American interest in ETH. Analysts believe this enthusiasm is potentially linked to the highly anticipated launch of an Ethereum ETF (Exchange Traded Fund). Similar situations occurred in March 2023 when a steep drop in the Gap coincided with ETH falling below $1,400. Conversely, a surge in March 2024, when the Gap reached a high point, propelled ETH towards $4,065.

Ethereum Price Poised for Rebound Despite Current Slump

While ETH is currently trading at $3,194, a significant decrease from its all-time high, the rising buying pressure suggests potential for price recovery. Data from IntoTheBlock’s In/Out of Money Around Price (IOMAP) indicator strengthens this possibility.

The IOMAP identifies price zones where large numbers of investors previously bought ETH. These zones act as potential support or resistance levels. Currently, over 3.56 million Ethereum addresses are “in the money,” meaning they purchased their holdings at an average price of $3,140. This concentration of addresses suggests a strong support level around this price point.

Breaking Through Resistance: Can Ethereum Reach $3,437?

Looking ahead, the IOMAP also identifies a resistance zone at $3,242, where over 2 million addresses bought a combined 4.01 million ETH. Overcoming this hurdle could see ETH climb further to $3,347.

Fear Gauge Presents Buying Opportunity

While the Ethereum Fear and Greed Index currently sits at a neutral 39, indicating neither extreme fear nor euphoria, it presents a potential buying opportunity. This, coupled with the bullish sentiment surrounding the ETF launch, could further fuel ETH’s price increase.

A Word of Caution: Market Volatility Remains

It’s important to remember that the cryptocurrency market is inherently volatile. A significant drop in overall investor interest could undermine the current bullish predictions. As always, investors should conduct thorough research before making any investment decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

The latest Crypto News on Blockchain, Crypto, NFTs, Bitcoin, DOGE, XRP, Cardano IOTA, SHIB, ETH, DeFi, and the Metaverse.