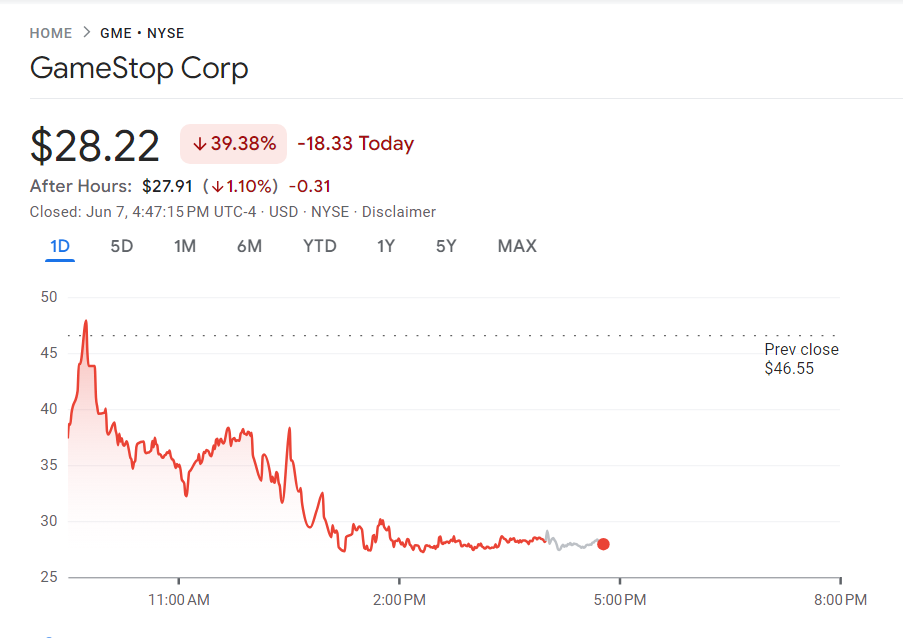

GameStop’s stock (GME) took a nosedive on Friday, plummeting 40% amidst a rollercoaster day of trading halts and a highly anticipated livestream by Keith Gill, better known online as “Roaring Kitty.” The sharp decline came after the company released disappointing quarterly earnings and announced plans to sell additional shares.

Earnings Miss Dents Investor Optimism

This news significantly overshadowed the 47% surge in stock price witnessed on Thursday, a rise attributed to investor anticipation surrounding Gill’s return to the public eye. GameStop’s financial results revealed a deeper-than-expected loss of $0.12 per share, missing analyst predictions of a $0.09 loss. Sales also fell short, reaching $882 million compared to the anticipated $995.5 million, marking a 40% decline. These figures dashed investor hopes for signs of a turnaround, leading to a sharp sell-off.

Roaring Kitty Reiterates Confidence, SEC Investigation Looms

Gill’s long-awaited YouTube stream, his first since the 2021 meme stock frenzy, saw over half a million viewers tune in. The livestream featured lighthearted visuals and a more open discussion about GameStop’s future, with a focus on Ryan Cohen, the company’s chairman. While reiterating his confidence in Cohen’s leadership and expressing a desire to see the company thrive, Gill made it clear that his past remarks shouldn’t be construed as financial advice. He further confirmed the authenticity of his social media posts showcasing substantial GameStop holdings, emphasizing that he trades independently on his own account.

However, this return to the spotlight coincides with increased scrutiny from regulators. Earlier in the week, Massachusetts’ securities regulator confirmed an investigation into Gill’s GameStop trades, highlighting concerns about the potential manipulation of stock prices through social media influence.

Share Dilution Fuels Further Volatility

Adding to the stock’s woes was GameStop’s announcement to issue up to 75 million additional shares. This move follows a similar sale of 45 million shares last month, which generated around $930 million. The company justifies this strategy as a means to capitalize on the stock’s volatility and bolster its financial standing.

The confluence of disappointing earnings, a significant share sale, and ongoing regulatory investigations has painted a bleak picture for GameStop in the short term. While Roaring Kitty’s return provided a temporary boost in investor sentiment, it wasn’t enough to offset the underlying concerns. Only time will tell if GameStop can navigate these challenges and regain investor confidence.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.