|

Getting your Trinity Audio player ready...

|

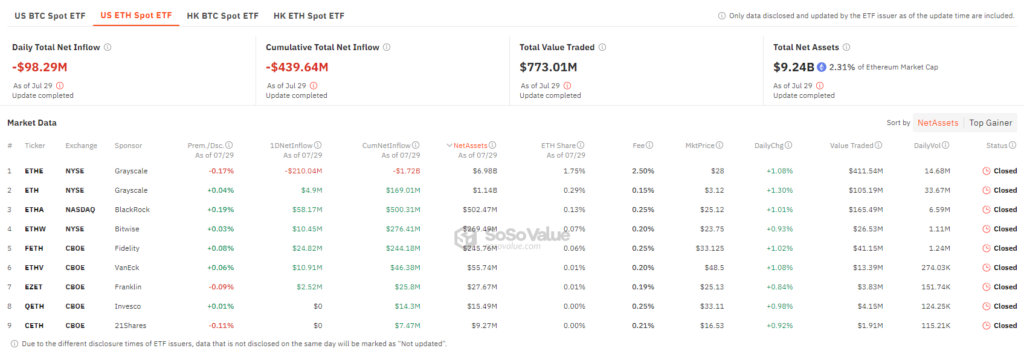

The initial wave of excitement surrounding the launch of spot Ethereum ETFs appears to be cooling down. New data shows that these products experienced a net outflow of $98.29 million on Monday, marking the fourth consecutive day of negative flows.

Grayscale Ethereum Trust (ETHE) continues to be the major outlier, with a staggering $210.04 million in net outflows. This follows a trend of substantial daily withdrawals since its debut last week.

In contrast, BlackRock’s ETHA led the pack of inflows, attracting $58.17 million. Fidelity’s FETH, VanEck’s ETHV, and Bitwise’s ETHW also saw significant net inflows. While Grayscale’s Ethereum Mini Trust and Franklin’s EZET recorded modest inflows, Invesco and 21Shares’ spot ether ETFs saw no net flows.

Daily trading volume for spot Ethereum ETFs has also declined, falling from $955.85 million on Thursday to $773.01 million on Monday.

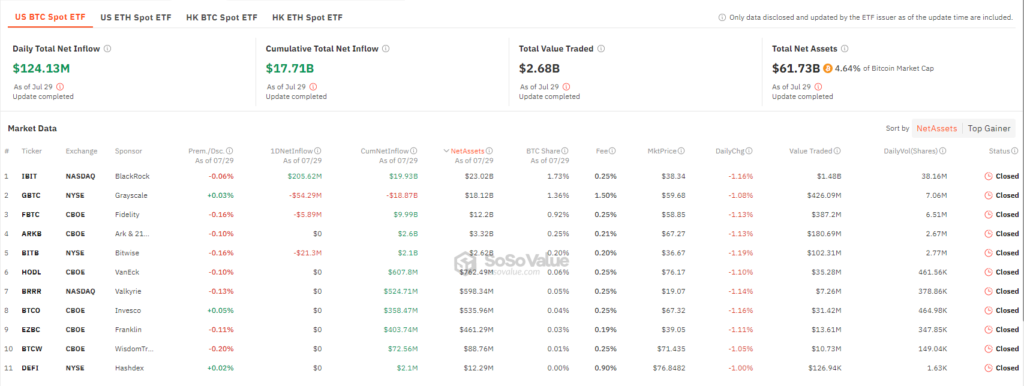

The Bitcoin ETF landscape presents a contrasting picture. These products collectively saw net inflows of $124.13 million on Monday. BlackRock’s IBIT was the standout performer, attracting $205.62 million in net inflows. However, Grayscale’s GBTC and Bitwise’s BITB experienced significant outflows.

Daily trading volume for Bitcoin ETFs surged to $2.68 billion on Monday, a notable increase from the previous days.

While the early days of spot Ethereum ETFs have been marked by volatility, the long-term outlook for these products remains uncertain. Investor behavior and market conditions will continue to shape the trajectory of these funds.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!