|

Getting your Trinity Audio player ready...

|

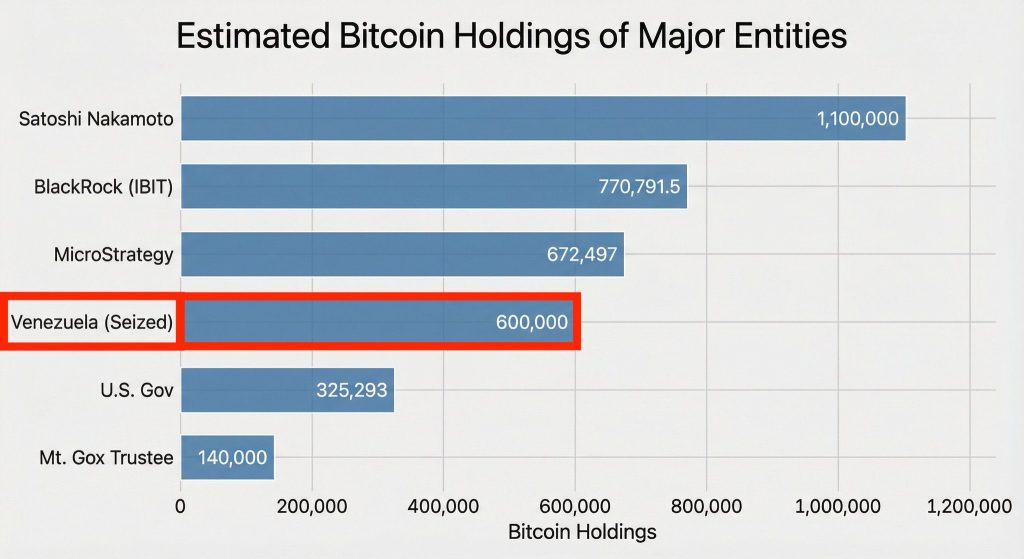

- Analysts claim Venezuela may control over 600,000 BTC

- Long-term lock-up could significantly tighten Bitcoin supply

- Market impact depends on whether assets are frozen, held, or sold

Bitcoin markets are digesting fresh claims that Venezuela may be sitting on one of the largest undeclared Bitcoin reserves in the world — a development that could reshape supply dynamics well into 2026.

According to intelligence cited by Whale Hunting analysts, Venezuela’s government may have quietly accumulated between $56 billion and $67 billion worth of Bitcoin and stablecoins over several years. If accurate, those holdings would rival the largest known institutional Bitcoin treasuries, placing Venezuela among the most influential players in the market.

A “Shadow Reserve” Built Under Sanctions

The reported accumulation dates back to around 2018, when Venezuela began converting gold from the Orinoco Mining Arc into Bitcoin as sanctions tightened. Analysts estimate that roughly $2 billion in gold was exchanged at Bitcoin prices near $5,000, potentially yielding around 400,000 BTC.

As sanctions expanded, oil transactions allegedly shifted toward USDT settlements. Intelligence reports suggest portions of those stablecoin flows were later converted into Bitcoin to reduce the risk of account freezes. Additional accumulation may have come from seized mining operations and crude-for-crypto arrangements between 2023 and 2025.

Combined estimates suggest Venezuela could control 600,000 BTC or more — a figure that would place it alongside corporate giants like MicroStrategy and major asset managers.

Why Bitcoin Supply Is the Real Story

Bitcoin’s reaction underscores the market sensitivity to supply shocks. Germany’s sale of roughly 50,000 BTC in 2024 triggered a sharp correction. A reserve more than ten times larger introduces far more complex scenarios.

Analysts outline three main possibilities. The Bitcoin could be seized and frozen by U.S. authorities, effectively removing it from circulation. Alternatively, it could be retained as a strategic reserve rather than sold, similar to long-term institutional holdings. A rapid liquidation remains the least likely outcome, given the potential market disruption.

Each scenario carries vastly different implications for liquidity and price stability.

Implications for 2026 Bitcoin Markets

If the Bitcoin is frozen or held long term, the effect would resemble a massive supply lock-up — structurally supportive for prices over time. While uncertainty may fuel volatility in the short term, reduced circulating supply could underpin higher price levels into early 2026.

Bitcoin’s recent surge toward $93,000 reflects how quickly geopolitical developments can spill into crypto markets. Increasingly, analysts argue that Venezuela’s true leverage may no longer lie in oil exports, but in the digital assets it may already control.

Whether confirmed or not, the reports highlight a new reality: state-level Bitcoin holdings now matter — and markets are watching closely.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

The latest Crypto News on Blockchain, Crypto, NFTs, Bitcoin, DOGE, XRP, Cardano IOTA, SHIB, ETH, DeFi, and the Metaverse.