|

Getting your Trinity Audio player ready...

|

Ethena (ENA) is on the brink of a significant market shift as it prepares for a colossal token unlock event. According to Tokenomist data, ENA will release 2.07 billion tokens into circulation this week, valued at approximately $820 million. This massive unlock accounts for a staggering 66.19% of ENA’s circulating supply, far exceeding other token unlocks occurring in the same period.

Market Impact of the ENA Unlock

Token unlocks often trigger increased volatility, particularly when the percentage of circulating supply being released is as substantial as ENA’s. The introduction of such a large supply into the market raises concerns over a potential sell-off, which could exert significant downward pressure on ENA’s price. However, if demand remains robust, it could absorb the new supply, mitigating drastic declines.

Historically, large unlock events have led to immediate price dips as traders anticipate increased selling pressure. Alongside ENA, Movement (MOVE) will unlock 50 million tokens ($23.14 million), while Solana (SOL) is set to release 465.7K tokens ($73.5 million). Additionally, Worldcoin (WLD) will introduce 37.23 million tokens ($43.18 million) into the market, further contributing to potential volatility.

USDe Redemption Adds Pressure

The token unlock event coincides with a historic redemption event for Ethena’s stablecoin, USDe. On March 1, USDe experienced its largest single-day redemption, amounting to 268 million tokens—causing a 4.7% drop in total supply. Notably, the largest redemptions came from addresses 0x59…705d (180 million tokens) and Sky (70 million tokens), further intensifying selling pressure on ENA.

ENA Price Analysis & Outlook

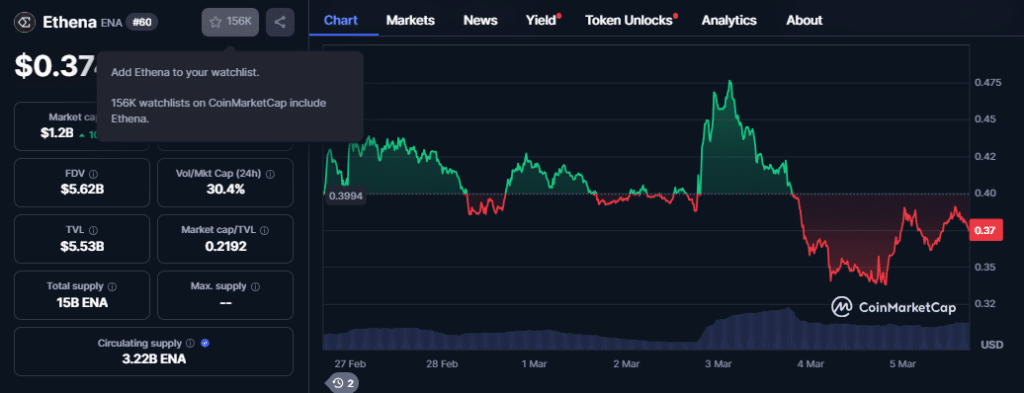

Currently trading at $0.3945, ENA has seen an 11% decline in the past day, with a market capitalization of $1.23 billion, according to CoinGecko. Technical indicators show that ENA’s Relative Strength Index (RSI) stands at 40.51, indicating weak buying momentum. Additionally, the token is trading near the lower Bollinger Band at $0.3754, with the middle band at $0.4325 and the upper band at $0.4896.

If selling pressure remains high, ENA could break below the $0.375 support, potentially dropping toward $0.30. Conversely, a strong buy-in could push ENA toward resistance levels between $0.43 and $0.49. The coming days will be crucial in determining ENA’s short-term trajectory amid heightened market uncertainty.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Ethena Team Moves $14.4M ENA to Binance

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.