|

Getting your Trinity Audio player ready...

|

- Corporate Bitcoin holdings rose 38% in Q3, reaching 172 companies.

- Total holdings now exceed $117 billion, representing nearly 5% of BTC supply.

- Analysts see the trend as proof of long-term institutional commitment to Bitcoin.

Stay ahead with real-time updates and insights—Join our Telegram channel!

The number of public companies holding Bitcoin surged 38% between July and September, underscoring that big players aren’t backing away from crypto—they’re moving in deeper. Bitwise Asset Management’s latest Corporate Bitcoin Adoption Report shows 172 companies now hold Bitcoin, up from 124 in the previous quarter.

$117 Billion in Bitcoin on Corporate Balance Sheets

According to data from BitcoinTreasuries.net, the total value of Bitcoin held by corporations has climbed to $117 billion—an increase of 28% quarter-over-quarter. Collectively, these firms now hold more than one million BTC, or about 4.87% of Bitcoin’s total supply.

Bitwise CEO Hunter Horsley called the growth “absolutely remarkable,” noting that both individuals and institutions “want to own Bitcoin.” The findings suggest a shift from speculative hype to strategic treasury positioning as corporations treat Bitcoin as a long-term store of value.

Big Names Lead the Charge

MicroStrategy remains the largest corporate holder, recently increasing its stash to 640,250 BTC following another purchase in early October. Mining giant MARA Holdings follows with 53,250 BTC after a fresh accumulation this month.

BTC Markets analyst Rachael Lucas said the data proves that “larger players are doubling down, not backing away.” She added that as regulation improves, more companies—and even governments—are likely to join the trend.

“This participation helps legitimize crypto as a mainstream asset class,” Lucas noted, “and sets the stage for broader financial innovation.”

Demand Rising Faster Than Supply

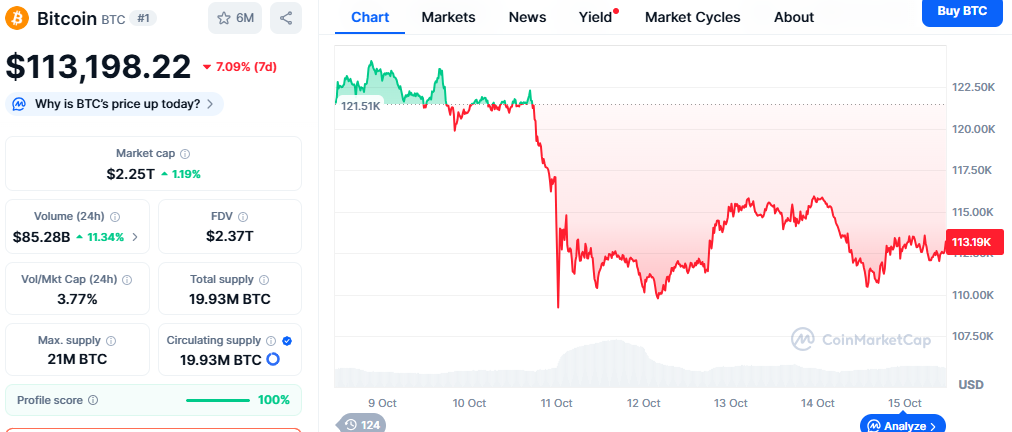

Despite this surge in accumulation, Bitcoin’s price has remained volatile. Analysts point out that many companies purchase OTC (over-the-counter), which doesn’t immediately impact spot markets. Still, with miners producing only 900 BTC per day and institutions reportedly acquiring nearly double that amount, a long-term supply squeeze could be inevitable.

Edward Carroll of MHC Digital Group believes this imbalance “will place upward pressure on Bitcoin’s price in the medium to long term,” predicting institutional demand will continue to grow steadily.

Beyond direct holdings, spot Bitcoin ETFs have added fuel to institutional adoption, with $2.7 billion in inflows last week alone. As Lucas put it, “Crypto is evolving from a speculative playground into a legitimate asset class.”

Stay ahead with real-time updates and insights—Join our Telegram channel!

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Larry Fink Now Calls Bitcoin a Legit Asset — BlackRock CEO Says BTC ‘Not a Bad Diversifier’

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!