|

Getting your Trinity Audio player ready...

|

- Bitcoin wallets holding 1,000 BTC or more have added 104,340 coins to their collective balances, a 1.5% increase.

- Total whale holdings have reached 7.17 million BTC, the highest level recorded since September 15, 2025.

- The frequency of daily Bitcoin transfers exceeding $1 million has climbed to a two-month high.

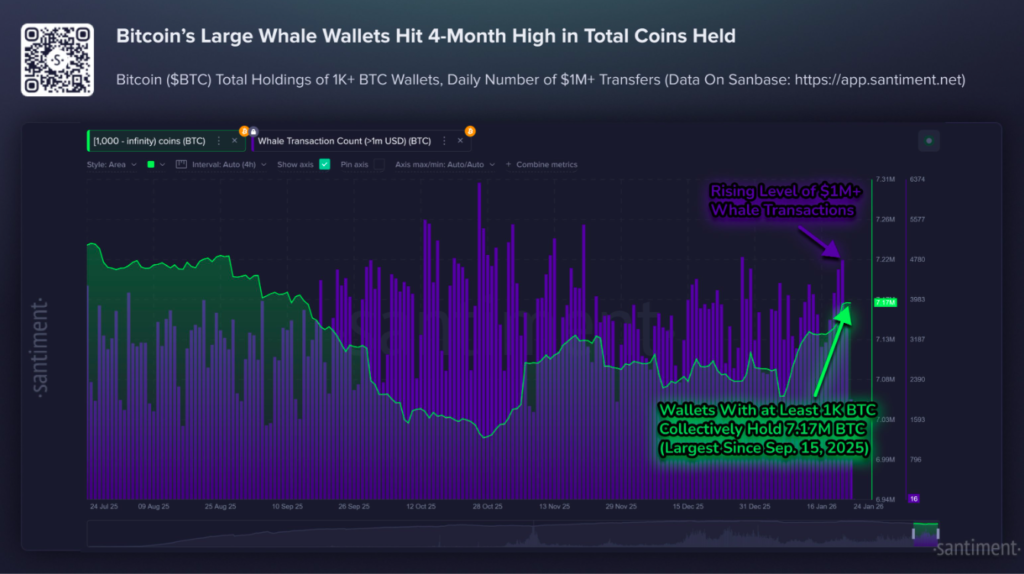

On-chain data released by market analytics firm Santiment on January 25, 2026, reveals a significant shift in Bitcoin ($BTC) ownership concentration. Large-scale stakeholders, commonly referred to as “whales,” have accelerated their acquisition of the digital asset, bringing their collective holdings to levels not seen since the previous year.

Metrics of Whale Accumulation

The report specifically monitors wallet addresses containing a minimum of 1,000 BTC. According to the latest figures, this specific cohort of investors has collectively accumulated an additional 104,340 BTC. This represents a 1.5% increase in the total supply held by these large wallets over a recent, unspecified tracking period.

As a result of this buying activity, the total quantity of Bitcoin held by wallets in the 1,000+ BTC category has reached 7.17 million BTC. This volume marks a four-month high for the group, representing the largest concentration of coins held by these entities since September 15, 2025. Santiment characterized the current rate of accumulation as “encouraging,” suggesting a strong conviction among the market’s most well-capitalized participants.

The accumulation trend is mirrored by a resurgence in network utility for large transfers. Daily transactions involving movements of $1 million or more have returned to a two-month high. This increase in high-value transfers indicates that institutional and high-net-worth activity is currently at its most frequent since November 2025.

Also Read: Tether Dominates Crypto Protocol Revenue in 2025, CoinGecko Data Shows

Status and Implications

The data identifies a distinct divergence in behavior between different holder classes, with the largest wallets aggressively expanding their positions. While the report confirms the increase in whale balances and transaction frequency, it does not specify whether these coins were acquired through exchange purchases or over-the-counter (OTC) trades. Furthermore, while the trend is termed “encouraging,” the report does not provide a specific price target or a definitive timeline for how this accumulation might influence broader market volatility.

Bitcoin’s largest holders currently control 7.17 million BTC, following a period of steady accumulation that has seen over 100,000 coins move into high-value wallets. With $1 million+ transfers hitting a multi-month peak, the on-chain environment for January 2026 is presently defined by heavy institutional and whale-level engagement.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.